SECOND QUARTER ECONOMIC OUTLOOK

US & World Economy

Over the past 8+ weeks, we’ve witnessed the fastest stock market sell-off in stocks in our country’s history, with a 34% sell-off in the S&P 500 from February 19 to March 23, only to rally 16% into the quarter-end. Last month’s price action brought the VIX volatility index to historically unprecedented levels, surpassing those seen during the height of the Great Financial Crisis in last 2008. Incredibly, during the lows seen on March 23rd, the median NYSE-listed stock was down over 50% from the highs. This volatility was also rampant in both the investment-grade and high-yield bond markets, which experienced the largest one-week sell-off in history. The week of March 23rd, the ICE BofA US High Yield Index widened from 357 bps to 1087 bps that is a tremendous move of over 700 basis points. It seems that a combination of extremely low levels of liquidity, margin calls and programmatic forced deleveraging was a very large contributor to much of the price action during some of the more chaotic sessions over the past month.

COVID-19 and its tertiary effects will likely prove to be the most acute disruption to the global economy in the last 100 years. Jobless claims in the US to mid-April have already totaled 22 million, a staggering shock to labor markets. Fortunately, COVD-19’s impact on public health, the economy and the financial system have been met with extraordinarily proactive measures by governments and Central Banks around the world. On the monetary policy front, there are an array of actions taken by the Fed Reserve to provide much-needed liquidity to bank balance sheets, US dollar currency swaps, and commercial paper market and what was briefly a highly dysfunctional market in US Treasuries. By stepping in early as a lender of last resort and liquidity provider, the Fed’s actions quickly unclogged the pipes of the financial system and funding markets, allowing for uninterrupted flow of payments and credit while corporate borrowers have drawn out over $2 billion in revolving lines of credit. On the fiscal policy front, Congress’s extraordinary actions have provided a much-needed stopgap for the American public as parts of our economy go offline. All politics aside, the recent bipartisanship in the face of a severe crisis is very reassuring that the US Government is both willing and able to work together to take effective steps to arrest the dual crisis in public health and the economy.

As tumultuous as markets have been, it is all the more important to step back and look at the larger picture. What we are experiencing is inherently temporary and the intrinsic value of a business is the present value of its future cash flows in perpetuity, and several quarters of poor earnings don’t drastically affect a company’s true value based on its long-term earnings potential.

As challenging as the past weeks have been to witness, our durable and diversified investment approach is the best way to mitigate the myriad list of risk factors even Black Swan events can bring us. Fortunately, we have the luxury to stay with our long-term time horizon as our counter-balancing investments mitigate our portfolio volatility. While we have made minor tactical moves, we have stayed close to fully invested so we can reap the windfalls that bear market volatility brings.

Looking Ahead – Post Crisis

Looking Ahead – Post Crisis

As we start-contemplating life after lockdown, one of the key discussions is how the ballooning federal deficit will be addressed in the new economy. One of the leading solutions that economists have begun to focus on is the prospect of higher taxation and inflation. This, in turn, will require additional investment and Financial Planning strategies to ensure any of these pressures are minimized.

Although governments could also seek to address debt through the use of inflation, there are drawbacks. Inflating away government debt is not as simple as it may first appear, both because, as seen in the past, generating inflation is not necessarily straightforward, and because higher inflation increases deficits. As large parts of government spending are directly linked to inflation, debt costs may rise where there is substantial inflation, and investors may demand an insurance premium if inflation uncertainty is high. As a result, we think it is unlikely that inflation would be allowed to deviate from a target rate for long, given the potential cost of adding to inflation uncertainty. That said, central banks may be prepared temporarily to tolerate a higher rate of inflation above their 2% target rate as long as it does not add to inflation uncertainty risk, and could help modestly reduce debt burdens.

However, moderations in inflation alone will not be sufficient to address the growing annual deficits we had before COVID-19, let alone any of the fiscal spending packages that continued to be unveiled. In particular, we expect to see higher taxes on large, transnational companies, and particularly on technology firms. This step was already being planned prior to the pandemic, and the demands of post-crisis government finance are likely to make this a higher priority. Tying taxes to where revenues are earned is also likely to appeal to a sense of fairness, and it also aligns with the trend of de-globalization, by targeting foreign firms.

We might also see certain governments impose higher taxes on the wealthy to help finance debts. Although no jurisdiction has yet come out with concrete announcements, such tax measures might include higher taxes on capital gains, income, or gifts/inheritance, or the introduction or increase of wealth taxes, or financial transaction taxes.

The result is that long-term financial planning and considering after-tax performance will become even more important. These could include the use of tax-efficient investment/divestment strategies, such as the netting of capital gains and losses, and tax deferral strategies, among others. There will also be even more incentive for selecting tax-advantaged asset classes or investment instruments example real estate investments that pass on depreciation deductions or eligible private equity-type partnership funds. Amid uncertainty about which taxes might go higher, investors should also consider whether they can diversify their assets’ tax status, for example by using tax-advantaged savings accounts like Roth IRA and 401ks, tax-deferred life insurance, and 529 College Savings Accounts. Last, but not least, estate planning with the purpose of thinking intentionally about life insurance, inheritance, and philanthropy will become even more prominent, not only due to uncertainty over taxes but also due to the existential experience of this pandemic.

Portfolio Management

Equities and fixed income markets experienced a sharp sell-off in March due to COVID-19 and its economic impacts across the globe. Based on recent market events, we have made strategic shifts to our portfolios. We have replaced small-cap stocks with fundamentally chosen individual company positions with Amazon and Disney. We believe that picking high-quality stocks with an easy-to-understand business model in this turbulent time can help us better navigate this storm. We are constantly evaluating different individual stocks to see if they are a good fit for the portfolios. We did not make any change in the international equities space. Our active fund within that space provided good downside protection for investors. We maintain our current allocations of US, international and EM equities. We are not actively timing the market by fully exiting or taking concentrated bets on any region.

We have made changes in Global Real Asset. We liquidated all our mutual funds and decided to stick with our niche: Direct Real Estate. Direct Real Estate might provide better diversification in this time of crisis. Our gold position serves as a good hedge amid market sell-off, up 3.93% in the first quarter.

We have also made several changes in Global Fixed Income. We strategically removed the Floating Rate fund due to the low-interest rates environment we are in. We also removed the short-term fixed income fund because of the credit stress in the market. We use the highest-quality bond (i.e. Short-Term Treasury) to park our short-term cash. Overall, we stick to our principal strategy, which involves two actively managed bond funds and a passive bond fund to have complete diversification benefits across regions and asset classes.

Within Alternative asset classes, we removed our long/short equities and absolute return funds. Those funds did not provide the downside protection we expected. Hence, we have allocated the portfolios to other existing alternative funds that have better protection in the time of crisis.

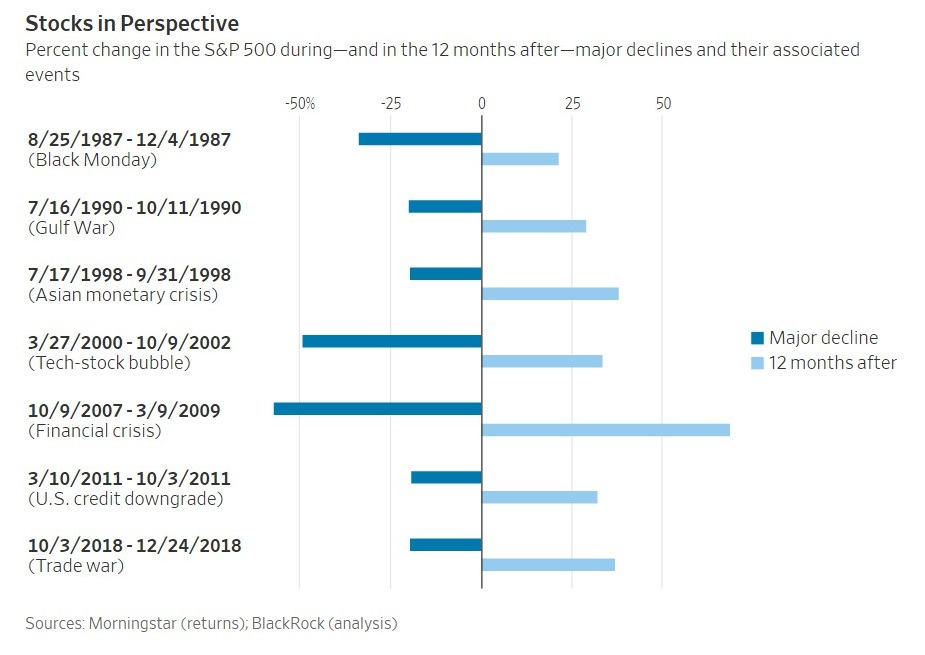

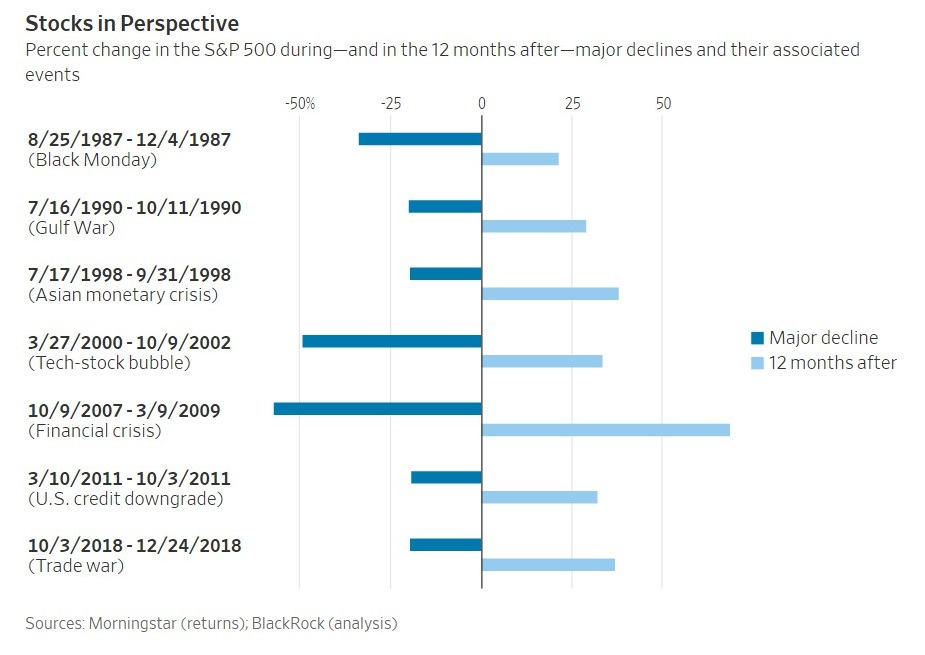

Hindsight is always 20/20. It is natural to feel that it would be smart to sell and avoid drawdowns before the crisis. However, we believe the importance of staying invested would have an immense benefit in the long-term. We are constantly monitoring the portfolios to ensure we are diversified to many asset classes and return sources globally.

The board of the Optivest Foundation is directing more funds locally during the COVID-19 crisis. We want to support our community and help through this crisis and we are open to learning of ways we could walk alongside you in support of local charities we may not know.

There are many ways we can all help that don’t require cutting a check – deliver food/groceries and medications to elderly, make and give away face masks, donate blood, pay for services you normally use while you stay-at-home and buy gift cards from your local small businesses. We can pull each other through this.

-Leslie

No one knows how quickly public-health officials will contain the coronavirus. The situation remains very fluid as rescue checks to taxpayers and loans to small businesses and self-employed parties are still in the works. There is likely another round of fiscal stimulus coming and we hope it works to assist borrower workouts with lenders.

Our strategy for the next couple of months is to reenter the stock market with the cash we raised early in the market drop as well as proceeds coming in from recent real estate sales. We have gotten a technical signal that we are in the clear for the market to recover. We already see a great recovery on NSA which we added to in the mid-’20s during this bear market and the preferred stocks we nibbled at. Gold has done really well to date. Going forward, we are buying individual stocks with strong credit and healthy balance sheets and are well equipped to thrive in a normalizing economy and have solid cash positions to survive a credit-constrained environment. We are also moving cash into our US-centric growth strategies as we continue our focus that the US is the most innovative and dynamic economy. Some reassuring stats to keep in the front of your mind:

The US will likely lead the charge to create a vaccine against COVID-19 and can look forward to seeing all our loved ones again soon. We will continue with our weekly news blasts to keep you apprised of our thoughts and progress. Through all of this, we encourage all of you to remember your long-term goals, be well and stay healthy.

The US will likely lead the charge to create a vaccine against COVID-19 and can look forward to seeing all our loved ones again soon. We will continue with our weekly news blasts to keep you apprised of our thoughts and progress. Through all of this, we encourage all of you to remember your long-term goals, be well and stay healthy.

Respectfully,

Leslie, Matt & Optivest’s Investment Department

The US will likely lead the charge to create a vaccine against COVID-19 and can look forward to seeing all our loved ones again soon. We will continue with our weekly news blasts to keep you apprised of our thoughts and progress. Through all of this, we encourage all of you to remember your long-term goals, be well and stay healthy.

The US will likely lead the charge to create a vaccine against COVID-19 and can look forward to seeing all our loved ones again soon. We will continue with our weekly news blasts to keep you apprised of our thoughts and progress. Through all of this, we encourage all of you to remember your long-term goals, be well and stay healthy.

Looking Ahead – Post Crisis

Looking Ahead – Post Crisis