At Optivest, our advice is built upon in-depth research and analysis that evaluates the ever changing global economic landscape. For insight into our strategies, you can explore our quarterly updates and economic thoughts below.

While we remain optimistic that we avoid a recession in the near-term, sticking a perfect landing seems overly optimistic hence we will keep our newly adopted more defensive stance in place until we see a reason to change in either direction. We want to remain exposed to areas where we see high-growth potential (innovation), on-shoring effects while keeping a watchful eye on a slowing but thus far resilient consumer and rising geopolitical escalations present risks that call for broad diversification and a moderately defensive stance at present. Its always something!

As we move through 2024, the current macroeconomic environment is challenging as we contend with domestic political issues, the larger geopolitical conflicts, and the Fed’s impact with the current rate environment. That being said, the American economy and country has always proven itself to be resilient and we believe that resilience will hold. The upcoming presidential election is sure to be one of the most challenging elections that we’ve ever seen, yet the turmoil that might come about will be limited by the likelihood of a mixed government made up of both parties. Having split control and the resulting necessity of bipartisanship helps suppress extreme ideas that have been discussed in the past such as taxing unrealized capital gains.

In 2022, the prevailing sentiment among professional investors and their firms was that the U.S. was headed towards a recession due in large part to the Fed’s aggressive monetary policy. The focal point of discussion revolved around the nature of the economic downturn – whether it would be a soft or hard landing. Either way, the nearly unanimous consensus was that this recession would be the most anticipated recession in history.

We have already arrived at the end of Q2 and the first half of 2023 and it feels like these past 6 months could have been 12. Market returns also feel like a full year of volatility and returns crammed into just 6 months. Coming into the year, we had expected US equity markets to be mainly range-bound, expecting the S&P 500 to trade between 3600-4200 during first half and for more volatility to return during the second half. But as of the end of 1H 2023, the S&P 500 has decisively broken out of that band to the upside and closed at 4450, retracing to the price level last seen around mid-April 2022.

Beneath a decent rally to start the year, risks to the economy remain. Even though headlines have focused lately on the Federal Reserve’s dual mandates of full employment and controlling inflation, the Fed actually has three mandates and includes maintaining financial stability. Getting all three to line up in the direction they intend often results in at least temporary impairment of one to benefit the others. This is why the phrase, “The Fed will break something” is part of our vernacular.

Happy New Year and we don’t mean this as simply a salutation, but we are genuinely happy to put 2022 behind us. What a year. The S&P 500 would fall more than 1% on 63 separate trading days during 2022. Since 1940, the only years with more downside volatility: 1974, 2002, and 2008.

What made this volatility much more difficult to stomach was the lack of support from the bond portion of investor portfolios. The last 8 years in which stocks finished lower, bonds rose, cushioning the blow. We saw a very different picture in 2022 with both stocks and bonds moving down together. The result was the worst year for a 60/40 portfolio of the S&P 500 and 10-Year Treasury Bond since 1937, and the first time both assets fell more than 10%.

While some markers of inflation are starting to cool, the labor market is still very tight, and there is a large amount of cash liquidity on household balance sheets as seen in record high levels of bank deposits. It seems likely that elevated inflation and interest rates will persist for a period of time, at least through 2023. Our forecast has been that financial market returns over the next five years to be modestly below long-term historical averages, so we have focused on income generation over growth investing.

Since the sharp COVID recession, while we all enjoyed great market returns and saw our residential property values soar, however growth was too heated and this current transition in valuations is toward more sustainable growth. The Fed is likely not done hiking but they might be able to slow the pace and magnitude of hikes soon.

Since early 2021 we have been shifting our portfolio models toward stable income generation through cash flow generating real estate and preferred equity exposures, mostly tied to real estate, to keep your income levels high when traditional fixed income has been punished by rising rates. Early in 2022, we reduced equity exposures to further push into low correlation income generating investments. During times of high volatility, we don’t have to focus on underlying asset valuations as much as the health and sustainability of cash flows to support your income needs.

Going forward we believe traditional correlations between equities and fixed income will eventually resume and active management will mean reallocating to high quality credit and eventually even high yield. Diversification still rules as our real estate exposure still generates higher returns than bonds. Real estate retains its value in portfolios by creating stability, higher yields and in many cases, tax-sheltered income.

This is not about a recession, at least not yet. Corporate profits continue to grow robustly along while pent-up demand for travel, consumption, investment, borrowing, and the housing market remains solid. Unemployment is at 3.6% while jobs available versus those seeking work is at a multi-decade low. This is about valuation and the reassessment of risk, with the forward price/earnings ratio for US stocks falling from more than 21 times in January to less than 18 today. As markets contemplate a Fed Funds rate discounted to increase to more than 2.5% by year-end, volatility and the positive correlation between stocks and bonds is a particularly challenging combination. Bonds will not, for some time, provide a hedge to stock volatility so real estate that adjusts/raises rents in inflationary times and alternatives that have low or negative correlation are a high priority to all investors. Diversification is more important than ever and real assets and alternatives are places to move and earn cash flows.

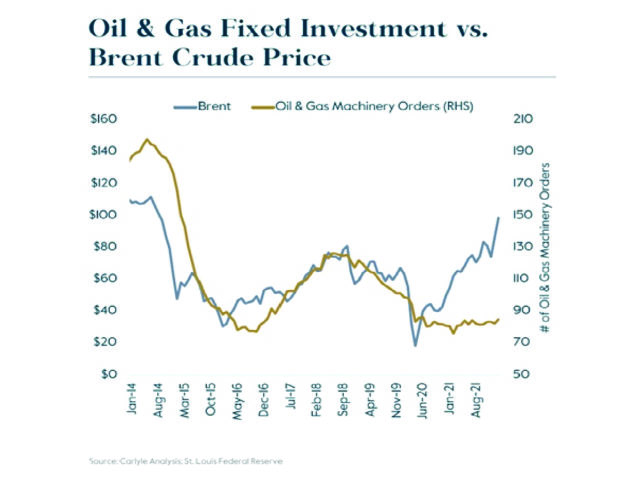

We are now in week three of the Russian invasion into Ukraine and the market is still trying to digest the different news stories that are making headlines and fueling volatility. While our thoughts are with the Ukrainian people who have been impacted by a conflict, not of their choosing, we are also focused on how this will affect the global economy, the energy markets, and the Fed’s response.