FIRST QUARTER ECONOMIC OUTLOOK – January 27, 2023

The Upside of Downside

by LESLIE CALHOUN, President and CEO

Happy New Year and we don’t mean this as simply a salutation, but we are genuinely happy to put 2022 behind us. What a year. The S&P 500 would fall more than 1% on 63 separate trading days during 2022. Since 1940, the only years with more downside volatility: 1974, 2002, and 2008.

What made this volatility much more difficult to stomach was the lack of support from the bond portion of investor portfolios. The last 8 years in which stocks finished lower, bonds rose, cushioning the blow. We saw a very different picture in 2022 with both stocks and bonds moving down together. The result was the worst year for a 60/40 portfolio of the S&P 500 and 10-Year Treasury Bond since 1937, and the first time both assets fell more than 10%.

And as you probably remember, Q1 and Q2 2022 showed us negative GDP growth. The last 10 times real GDP fell in consecutive quarters, a recession had been declared by the NBER. But as of this writing, there’s still been no announcement, suggesting this may be the first time since 1947 that consecutive declines in real output did not rise to the level of an “official” recession. Countering the recession declaration are two data points. First, the US economy had fully recovered from the Q1-Q2 downturn by the 3rd quarter of 2022. And while year-over-year growth has slowed to 1.9%, it’s still positive. Second, the jobs market remains strong, with payrolls hitting a new high in July (recovering all of the 22 million jobs lost during the pandemic shutdowns) and the Unemployment Rate moving down to 3.5%. This is tied for the lowest rate we’ve seen since 1969, and not behavior you typically will not see during a recession.

In most years there’s a spirited discussion about the health of the U.S. economy, but in 2022 the debate rose to new levels and no matter how much you want to look at history for a guideline to predict what’s ahead, there are so many unique variables that a comparison just doesn’t work. Currently, households, businesses, and financial institutions are in a much better position to handle any eventual downturn; savings levels are still historically very high. Drawing parallels with the 1970s, 1980s, 2008, or 2020 seems misplaced. This makes predicting a recession based on the same data ineffective. Yet it is abundantly clear: So long as financial markets function as intended, policymakers are willing to accept asset price volatility and a deterioration in macroeconomic fundamentals as a consequence of fighting inflation. “Don’t fight the Fed.”

In 2022 we saw P/E contraction and in 2023 we will likely see a period of earnings compression but this may not last as long as some think, and much of this may already be priced in. Gluts in inventories are done cutting into GDP growth. There’s been a drop in purchasing managers saying their inventory levels are too high. Secondly, the US Dollar has weakened which supports exports and this might start with minimal impact but has legs. Those legs might start to form in fits and spurts as the European Central Bank (ECB) will continue to tighten increasing the odds of a recession in the near term and China will begin the enormous task of reopening its economy by relaxing Covid controls, promoting vaccine and drug development, and improving hospitals. But expanding back to higher export levels will help US exporters after the damage the Dollar’s run brought in 2022.

While the sentiment is much more negative today than a year ago, long-term investors are actually in a much better place because every major asset class has seen an increase in yield, including Treasury bills, Treasury bonds, corporate bonds (investment grade & high yield), REITs, and equities. And higher yields are indeed a good thing, as they tend to pave the way for higher long-term returns. That’s the upside of downside.

Secure 2.0 – more flexibility & new strategies

by MATT McManus, Senior Wealth Advisor and COO

As you may or may not be aware, at the end of 2022, new legislation was passed called the SECURE 2.0 Act of 2022. SECURE 2.0 contains 90 provisions aimed at modernizing the retirement system. The changes will have at least some impact on most plans and do open some additional Financial Planning strategies to consider when making decisions. Below you’ll see a highlight of some of the notable provisions and some thoughts on how one might take advantage of the new rules.

Required Minimum Distribution Age

One of the more notable universal changes that affect most people who are not already 72 is the change to the required minimum distribution (RMD) age. RMDs are the provision that requires almost anyone with non-Roth qualified money to take distributions each year after reaching the age threshold. Before 2017 it was 70 ½, then changed to 72 with the 2017 tax law change, and now with the Secure 2.0 update it is changing again. The age for required minimum distributions is now increased to age 73 for persons who reach age 72 after 2022 and age 73 before 2033, and further increases to age 75 for persons who reach age 74 after 2032. The difference this time around is that the implementation of the overall change in RMD age is being spread out over an elongated period.

Now please remember, that this is the minimum age when you must withdraw funds from your IRAs and qualified plans. When we go through a Financial Planning analysis, it often makes sense to begin taking distributions earlier (as soon as 59 ½) in either direct cash to help supplement your cashflow needs or to accomplish a series of Roth conversions. Now, when Roth conversions are completed the total distribution amount is fully taxable in the year of distribution like a cash distribution would be. However, once the funds or securities are in your Roth account (provided you meet the rules for withdrawals) there are no taxes due on any future distribution. More notably as well, any beneficiaries that inherit your Roth accounts do not pay any taxes as opposed to inheriting a Traditional IRA when ordinary income tax is still due. The other benefit of taking distributions early, or in the form of Roth conversions, is the aim of lowering your overall tax burden throughout your retirement. When left to take RMDs at the full age, often the tax due on those distributions tends to increase your marginal tax brackets and therefore your total cost of retirement.

By Secure 2.0 pushing the RMD age out further, it gives us more time to complete gradual cash distributions or a prolonged Roth conversion strategy. This is a win for someone in either case because along with your tax professional, we can better plan around your tax situation each year to try to maintain as much tax efficiency as possible.

Qualified Charitable Distribution

With 90 new provisions included in Secure 2.0, it would be easy to miss some of the opportunities. One of these is the changes to the Qualified Charitable Distribution (QCD) rules. Previously, individuals who are 70½ years old or older may use a QCD to donate up to $100,000 to qualified charities directly from an IRA. The idea is that instead of taking your RMDs and paying tax on them, you can instead gift your RMD pretax (up to $100,000 annually) directly to a charity of your choice. If you are philanthropically inclined, this is a great way to enhance your charitable giving and create tax efficiencies.

Starting in 2024, Secure 2.0 has changed the annual IRA QCD limit of $100,000 to be indexed for inflation The bill did not indicate any change to the current QCD age and QCDs continue to be ineligible for a donation to donor-advised fund sponsors, private foundations, or supporting organizations.

However, on the planning front, the rule change also enacted a new provision to allow a one-time, split-interest election: Section 307 includes a one-time election for a QCD to a split-interest entity. This indicates an ability for donors to make a QCD of up to $50,000 to fund one of either a Charitable Remainder Unitrust (CRUT), Charitable Remainder Annuity Trust (CRAT), or Charitable Gift Annuity (CGA). Now a one-time distribution will not make a marked difference in a charitable strategy. However, hopefully, this indicates that in future legislative changes, there may be some further flexibility in this area to augment any charitable trusts you may have already put into place. This rule becomes effective starting in 2023.

RMD Penalty Adjustment

Along with all the adjustments to the RMD age, Secure 2.0 also provided some flexibility to what was a very draconian set of penalties. Current law imposes an excise tax on an individual if the RMD amount distributed in a given year is less than the RMD that is required. The previous tax was equal to 50% of the shortfall (that is, 50% of the amount by which the RMD exceeds the actual distribution). Oftentimes, either because of paperwork, timing, or other factors RMDs that were not done correctly had to pay an immediate tax with very little exception. The new rules reduce the excise tax for failure to take RMDs from 50% of the shortfall to 25%. Going even further the new rule reduces the excise tax to 10% if the individual corrects the shortfall by the end of the second year following the year it was due. So, for example, if you fail to take an RMD due in 2022, the penalty is knocked down to 10% if you withdraw the necessary funds by December 31, 2024. These penalty-reduction provisions apply beginning in 2023.

529 to Roth

In a brand new approach, Secure 2.0 has created a bridge between 529 plans and Roth IRAs. 529 plans are notoriously known for offering tax-free growth and distributions if your expenses meet the qualifying expenses as determined by the IRS. Often, if a child didn’t follow a clear path through undergraduate and graduate schools, you may end up with an account that could not be utilized without penalty and loss of tax benefits. In 2017, the law expanded other qualifying institutions for k-12 that allowed more options in disbursements. In addition, a 529 plan beneficiary can be changed by the account owner to immediate family, including other children, grandchildren, or even themselves. Yet the risk of having utilized 529 balances was still a concern until Secure 2.0.

Previously, amounts in 529 plans not used for qualified education expenses may not be rolled over to a Roth IRA or other types of retirement plans. The new rule allows certain assets in a 529-qualified tuition program account maintained for at least 15 years for a designated beneficiary to be directly rolled over on a tax-free basis to a Roth IRA maintained for the benefit of the beneficiary. The rollover is subject to the limits on Roth IRA contributions and the requirement that a Roth IRA owner has includible compensation at least equal to the amount of the rollover. Permitted rollovers would be limited to (1) the aggregate amount of contributions to the account (and earnings thereon) before the 5 years ending on the date of a rollover, and (2) a lifetime limit of $35,000.

Although the rule update limits the lifetime rollover to $35,000, it does show that the IRS recognizes the limitations based on the nature of the 529 plan to cause unnecessary complications. In certain circumstances when there is no clear need for existing funds in a 529 plan, it may be worth considering rolling those funds out. The rule becomes effective starting in 2024.

Summary

The Secure 2.0 rule changes are complex and will continue to evolve as the IRS builds the framework to implement the changes. That being said, several key themes include more flexibility in the distribution of assets from varying accounts and a desire to streamline several previous administrative hurdles. The timeframe for a number of the changes is elongated and will be implemented gradually. However, as we are creating for the first time, or refining your Financial Plan, some of these changes may greatly add some flexibility and tax efficiency to your plans.

Portfolio Management

Portfolio Management

by RYAN THOMASON, CFA, Associate Portfolio Manager

Investment Strategy Spotlight – US Value Equity

It is easy to forget that the Fed was holding the federal funds rate at around zero as recently as the first quarter of 2022. The Fed was also still buying billions of dollars of bonds every month to stimulate the economy. All of this was in the name of “transitory” inflation, which was at a 40-year high.

The Fed changed its messaging of transitory inflation in December 2021. The term “transitory” had been dropped entirely and Chair Powell acknowledged that demand-side factors were contributing to inflation, which implied that prices would not return to normal unless the Fed took action to bring prices back down. Once the Fed decided it was time to act, it moved forcefully and raised the fed funds rate from 0.25%-0.50% to 4.25%-4.50% in nine months. This event severely impacted nearly all liquid assets, especially those that were long-duration in nature.

Equities in general tend to be long-duration assets. The entire basis for stock investing is to receive partial ownership of the future cash flows of a company in perpetuity. Companies utilize those cash flows to pay a dividend, buy back stock, or reinvest the cash flows into the business to support growth. The typical method for valuing a business based on those cash flows is a discounted cash flow model, which discounts future cash flows at the risk-free rate plus an equity risk premium. Lower discount rates produce higher equity values and vice versa; however, the effects vary by equity styles. Value stocks tend to have more mature cash flows that grow at low, steady rates, while growth companies typically produce little to no positive cash flows at the beginning of their life cycle but eventually generate large cash flows later on. Because value companies tend to have more stable cash flows throughout their period, their market value is better insulated when interest rates increase.

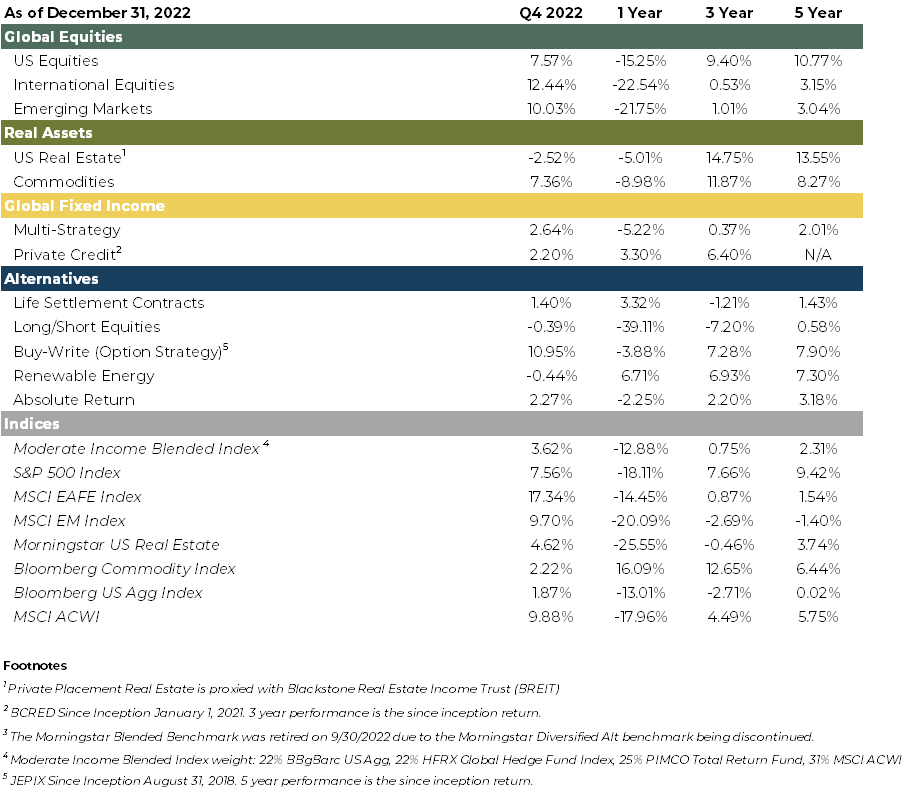

At Optivest, our Investment Committee decided to trim equity positions that had long-duration cash flows to preserve capital from losses throughout 2022 as we expected the Fed to continue hiking interest rates throughout the year. It wasn’t until the consumer price index (CPI) showed signs of deacceleration that we decided it would be prudent to invest the cash into US value equities, as they would perform stronger relative to growth equities in a heightened interest rate environment.

We aimed to invest in businesses that were of high quality, had high free cash flow as a percentage of their enterprise value (free cash flow yield), and were paying dividends. This led us to invest in the Pacer US Cash Cows 100 ETF (COWZ). The fund uses an objective rules-based methodology that uses a quality screen of free cash flow yield to select the top 100 companies from the Russell 1000 index. We believe free cash flow yield is a very strong measure of the quality of a company for several reasons, some of which include that it is very difficult to manipulate from an accounting perspective, it allows companies to access plentiful cash in times of distress, and it is often directly related to profitability. Since 1994, free cash flow yield has outperformed other US equity factors by more than 400 bps per year and has outperformed the S&P 500 by 7% on average. The result of the quality screen on the Russell 1000 Index is an increase in free cash flow yield from 3.42% to 12.48% and a decrease in P/E of 20.6x to 6.6x. This means we are owning higher cash-flowing businesses that are at very attractive valuations. Lastly, while the quality screen does not take into consideration dividend yield, the fund still produces a 2.0% yield.

For those who need to generate higher income but also want to invest in defensive, high-quality businesses, the iShares Select Dividend ETF (DVY) offers an attractive 3.6% yield. The fund tracks the investment results of the DJ Select Dividend Index, which screens equity securities issued by companies that have provided relatively high dividend yields consistently over time. It also screens out stocks that have a negative historical five-year dividend-per-share growth rate or have not paid dividends in each of the previous five years. Investing in a portfolio that is designed to offer a high dividend yield has attractive risk-adjusted returns. Shares of companies that pay, grow, or initiate dividends have historically delivered returns that are less risky relative to shares of companies that do not pay, cut, or eliminate their dividends. Lastly, dividend-paying stocks have tended to weather down equity markets better than non-payers. The ability to consistently pay dividends suggests that a company is mature, and has cash flow and cash on hand. In other words, strong cash flows are a sign of a company that is relatively stable. While never guaranteed, corporate boards tend to set dividends at levels that can be maintained.

As we rebalance equity portfolios to a more defensive and higher quality positioning, we will continue to look at the data to decipher whether the impending recession will be a soft- or hard landing. We will also continue to monitor inflation, which may continue to be volatile as the Fed interest rate outlook differs from the market’s interest rate outlook. Since we don’t have a crystal ball, it is better to be on the defense rather than the offense in this challenging market environment.

Client services & IT

Client services & IT

by ASHLEE ENZENSPERGER, Director of Client Services and IT

The Modern K-1 Checklist – Updated Process

We are quickly entering the new tax season. We at Optivest remain committed to getting your available tax documents to you and your CPA/Tax Professional in as easy and timely a way as possible.

This year we have created a new way for you to access your Optivest investment-related tax documents. In the next few days, you will receive an email with a link to your secure cloud-based folder, which will contain your 1099/K-1 Checklist. In addition, when new tax documents are received by our office they will be added to the same folder for future access.

Please respond to this email if you would like your CPA/Tax Professional to also receive the link.

We look forward to this being a more modern and streamlined method to help ease the tax document tracking and gathering process.

Spotlight on our new client services associate

Spotlight on our new client services associate

by KATHERINE ZELTNER, M.B.A., Client Services Associate

Katherine Zeltner serves as the Client Services Associate for Optivest. She is the client’s main point of contact for any operational need and ensures all clients’ transactions are handled smoothly. Katherine’s quick thinking, dependable nature, and quality customer care have made her a trusted resource to the firm.

Before working at Optivest Katherine served 6 years in the finance industry with Morgan Stanley and Fisher investments. Most recently she worked as a Global Custody Management Associate at Fisher investments maintaining relationships with six of the Firm’s custodians and helping to improve operational processes.

Katherine obtained her Bachelor’s degree from California State University, Fullerton, and went on to receive her Master’s of Business Administration from Chapman University.

Outside of the office, Katherine enjoys cycling, snowboarding, and hanging out with her German Shepherd, Dallas.

Summary

Periods of poor market performance WILL happen as evidenced by the dismal year of 2022. However, over the long term, diversification means having exposure to numerous asset classes that act differently during periods of both up and down market performance as well as in flat and sideways markets, providing hedges to weather all market conditions. High-quality companies remain our mainstay for their healthy balance sheets/low leverage and their economic moats and dominance. The ability to produce steady cash flow remains of utmost importance.

We will continue to weigh the evidence as it comes, invest based on probabilities, and focus on steady income generation. That’s the best you can do in this fickle business of investing – try to find the right path for you and stick with it long enough to reap the enormous benefits of compounding growth.

Respectfully,

Leslie, Matt, Ryan, Ashlee & Katherine