THIRD QUARTER ECONOMIC OUTLOOK – July 26, 2023

Odds of a Recession Declining

by LESLIE CALHOUN, President and CEO

We have already arrived at the end of Q2 and the first half of 2023 and it feels like these past 6 months could have been 12. Market returns also feel like a full year of volatility and returns crammed into just 6 months. Coming into the year, we had expected US equity markets to be mainly range-bound, expecting the S&P 500 to trade between 3600-4200 during first half and for more volatility to return during the second half. But as of the end of 1H 2023, the S&P 500 has decisively broken out of that band to the upside and closed at 4450, retracing to the price level last seen around mid-April 2022. The biggest drivers of this first half surge, which for the S&P is close to ~16%, has been the Technology, Communications Services, and Consumer Discretionary sectors, each delivering over 30% returns for the first 6 months, and the tech mega-caps outpaced other index constituents by a huge margin. Meanwhile, the Energy sector which delivered a staggering 50+% return last year has lagged every other S&P 500 sector during the first half of 2023. We’ve seen a 180 from last year – last year’s worst performers are this year’s superstars.

Both the stock and bond market have been volatile again this year having experienced the first real financial accident spurned by swift rate hikes over the past year which ultimately led to 2 US regional bank failures and a last minute salvo to sell Credit Suisse to UBS, a last minute resolution on the debt ceiling after which US stocks rallied. In the face of so much uncertainty, the economy has brought good news in continued low unemployment, declining wage pressure, headline CPI coming in slightly lower than expected, the Fed’s pause, and a higher than expected Q1 GDP revision. The US economy has proven resilient and yet while the yield curve inversion signals an upcoming recession, we feel the recession risk has declined dramatically and feel even more confident that without another financial accident, a soft or “bumpy” landing is possible, particularly as we see impact of yet another government stimulus to small businesses in the form of ERTC (Employee Retention Tax Credit). Contrary to headline news, more businesses than average took on longer term low rate debt in the years preceding the huge jump in Fed Funds rate. Additionally, we see that many businesses have been successful in keeping prices higher and those experiencing margin pressures are cutting prices, slowing hiring, cutting benefits and adding technology to offset the impact of higher rates this year. As inflation and consequently growth slows, the rate hike regime is subject to stalling out and could even see a decline before the maturity bulge of commercial real estate debt maturities come which grows steadily from 2024 – 2027.

Like the US, the Western developed Central Banks have moved aggressively to tighten monetary policy in an effort to curtail the worst inflation in decades. A variety of forces have helped sustain European economic momentum so far in 2023 but we expect tightening credit conditions to weigh on credit growth over time, helping to reduce inflationary pressures but also causing an economic slowdown.

In contrast with major developed market economies, China is in a markedly different place in its cycle. The relaxation of Covid-19 restrictions has driven a meaningful but less rapid recovery. Services activity has seen the most pronounced pick-up while slowing global demand has meant softer industrial production and exports. China’s growth is less certain because they have yet to set policies that address the teetering property market and counter demographic headwinds.

Real Estate – The Trifecta Asset Class that offers Income, Growth, and Tax Efficiency

by MATT McMANUS, Wealth Advisor and COO

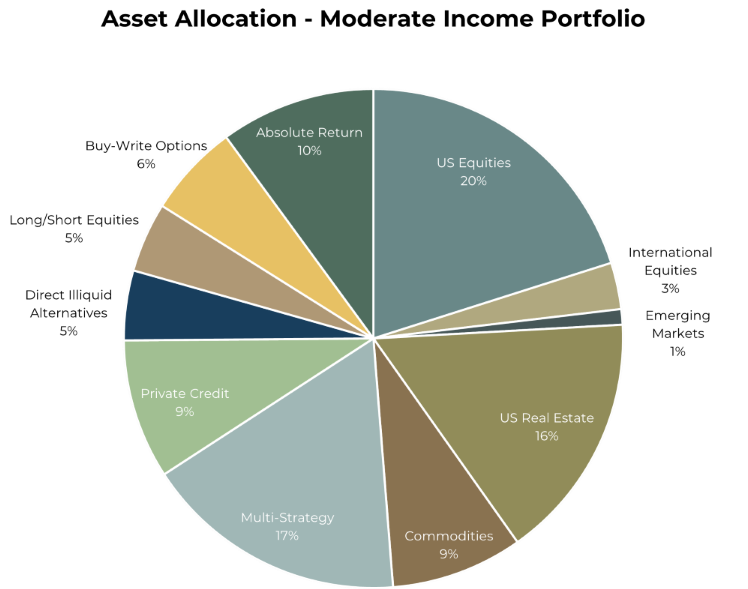

At Optivest, we are unique in differentiating between Alternatives and Real Estate as asset classes in our model portfolios. Although many firms consider them one in the same, we know that they each have their respective roles in a diversified model portfolio. The purpose of Alternatives is to dampen volatility and generate returns not correlated to the equity and bond markets. Non-Traded Real Estate or REITs on the other hand have a very different role in a portfolio as they can produce income, opportunities for capital growth upon exit, and the flexibility of offering tax efficiency.

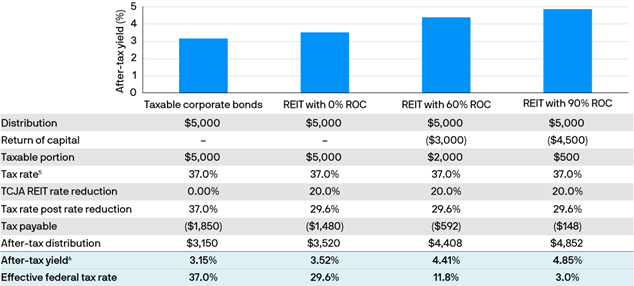

REIT distributions typically fall into three categories: ordinary income, capital gain, or a return of capital (ROC). The tax treatment of each category is based on the nature of the returns. As you know, ordinary income is taxed at your regular personal income tax rate, which is typically higher than the rate for capital gains. However, REIT investors also currently benefit from a 20% reduction in their individual tax rate for the ordinary income portion of REIT distributions, thanks to the Tax Cuts and Job Act (TCJA) of 2017.2 For example, if your tax rate is 37.0%, your effective tax rate for your ordinary REIT dividends would be 29.6%.

Capital gains of course refer to the profit from selling an investment. Long-term capital gain – earned when you have held an investment for at least a year before selling at an appreciated price – is taxed at a rate that is lower than most of the income tax rates. The highest individual capital gain tax rate is 20%. Therefore, in most cases, it is to your advantage to have income taxed as a capital gain, rather than as ordinary income.

Return of capital (ROC) distributions further benefit from real estate-related tax deductions. As real estate vehicles, REITs are able to claim tax deductions for depreciation and amortization, which reduces the REIT’s net taxable income but do not reduce its cash. This feature potentially allows a portion of the distribution’s REITs pay out to be classified as ROC, rather than dividends taxable as ordinary income or capital gain. The ROC distributions may possibly reduce the taxable portion of distributions by an estimated 60%-90%

Here’s also where ROC diverges from ordinary income and capital gain, from a tax perspective: Instead of being included in your taxable income in the year received, an ROC distribution is accounted for by reducing the tax basis in your REIT shares by the amount of the ROC distribution. As long as the ROC distribution does not exceed your tax basis in your REIT shares, the taxes due on the ROC portion of the distribution are generally deferred until the shares are sold. If a ROC distribution exceeds your tax basis, it is generally taxed as a capital gain, and is taxable as a long-term capital gain if you held the REIT shares for more than a year.

REITs, therefore, have the potential to be relatively tax-efficient investments because of their ability to use ROC distributions to both defer taxes and potentially reduce them to the typically lower capital gain rate.

The following hypothetical example illustrates how the tax treatment of ROC can improve the tax efficiency of REITs by comparing a non-REIT investment to REIT investments with different percentages designated as ROC.

Tax impact of ROC assuming $100,000 investment and an annualized pre-tax yield of 5% ($5,000 annualized distribution)

Source: J.P. Morgan Asset Management. For illustrative purposes only.

As shown in the above example, after the TCJA REIT tax rate reduction and ROC of varying amounts; 0%, 60% and 90% are combined with the associated tax rates, the effective federal tax rate may be reduced from 37.0% to 29.6%, 11.8% and 3.0%. As a result, the effective yield from each investment increases as the effective tax rate decreases. In order to match the 0%, 60% or 90% ROC REIT after-tax yield, a taxable fixed income investor would need to find a 5.6%, 7.0% or 7.7% pre-tax yield investment.

Each real estate investment must first be considered on its own merits, regardless of tax efficiency. However, we at Optivest look for real estate opportunities that can offer the chance for income, growth, and after-tax returns that can be impactful in your portfolios. In addition, every investor’s tax status is different, and you must confer with your tax professional to determine what tax efficiencies may be available from each investment opportunity.

The Late Innings of The Fed Rate Hike Cycle

The Late Innings of The Fed Rate Hike Cycle

by RYAN THOMASON, CFA, Associate Portfolio Manager

The US economy has demonstrated resilience during the first half of the year, bolstered by stronger-than-expected economic data and robust corporate earnings that have supported the markets. Consequently, many market strategists have postponed their recession predictions from the latter part of 2023 to 2024. However, despite the impressive performance in the first half, the outlook for the economy going forward indicates a deceleration in growth due to the tightening of credit conditions, which will likely exacerbate the challenges to economic activity.

As anticipated, the Federal Reserve (Fed) raised interest rates by an additional 25 basis points. They are now expected to pause but not cut, leaving interest rates at higher levels until specific conditions are met. These conditions include observing a rise in unemployment, continued downward movement in disinflation, and a weakening of consumer spending.

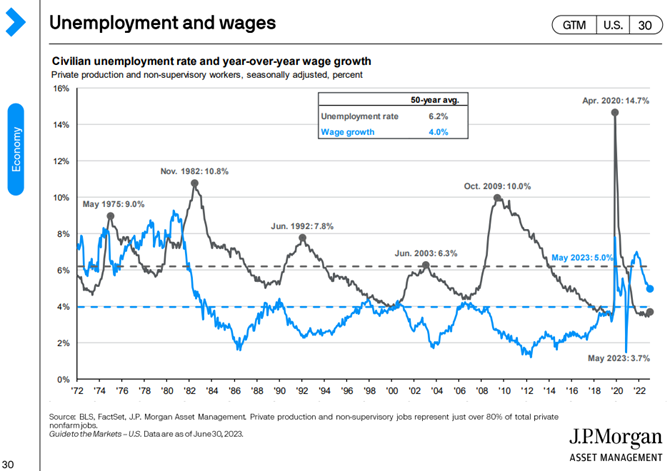

A tight labor market has kept the unemployment rate close to its 50-year low of 3.6%, despite a decline in demand. Notably, cooling labor market conditions have resulted in a moderation of wages, which only grew by 0.3% month-over-month. This is a significant decrease compared to the same period one year ago. The question arises: when will we witness a rise in unemployment, as it seems to be the one area the Fed has not made any significant progress against?

Several factors contribute to the complexity of the situation. US businesses are still grappling with a smaller labor force, legal immigration has seen a notable decrease, and a larger portion of baby-boomers retiring has resulted in a reduced pool of available workers. Due to these factors, a substantial increase in the unemployment rate is not anticipated. However, wage growth is expected to continue decelerating, which should give the Fed confidence that inflation is sustainably decreasing.

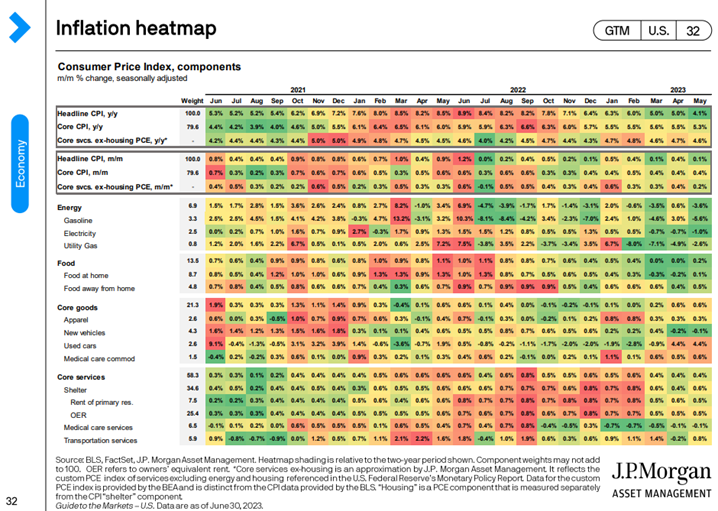

After almost two years of grappling with high inflation that has put pressure on consumers and contributed to rising interest rates, we are finally witnessing a deceleration in inflation. As illustrated below, there has been a moderate pace of monthly core inflation over the past seven months. The most persistent aspect of inflation, shelter costs, is now showing signs of easing. Since it reflects market conditions with a significant lag, it is expected to continue declining over the next year, reflecting a slowdown in price increases for new rental market transactions. While inflation has not dropped as rapidly as the Fed had hoped, it is still gradually declining towards more manageable levels.

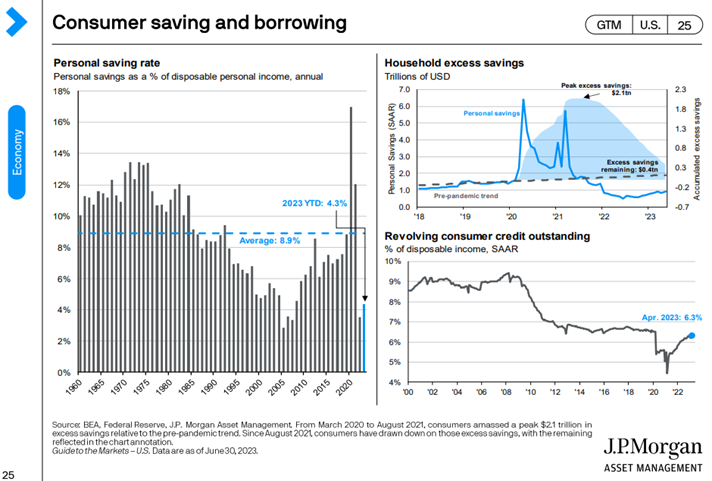

The US economy relies predominantly on consumer spending, making it challenging for the Fed to achieve its 2% inflation target without burdening consumers. So far, both the economy and consumers have shown resilience. However, the resumption of student loan payments and the depletion of savings may prompt consumers to adopt a more cautious approach to spending. Encouragingly, there are indications that the Fed’s higher interest rate policy is starting to impact consumer behavior.

During the first year of the pandemic, the savings rate surged as the shutdown in activities and large fiscal transfers boosted consumers’ wallets. Nevertheless, as business returned to normal, pent-up demand and rapidly rising prices compelled consumers to dip into their excess savings to support their spending habits, causing the savings rate to fall below average levels. Consequently, with the personal savings rate at these levels, consumers have been compelled to utilize their extra savings and rely more heavily on credit.

Throughout this year, there have been numerous twists and turns that have altered the trajectory of our economy and the Fed’s rate-hiking cycle. At the end of the first quarter, concerns arose that stresses within the U.S. regional bank system could escalate into a full-blown crisis, raising the likelihood of a recession in the first half of the year. However, the second quarter presented a different picture with resilient growth, the successful containment of regional bank issues, and a significant rally in the S&P 500 fueled by the widespread adoption of artificial intelligence. Barring any unforeseen external shocks to the economy, we now believe that the probability of a soft-landing has increased compared to previous assessments. As we mentioned at the beginning of the Fed’s rate hiking cycle, the Fed faced an extremely challenging task of raising rates without triggering a recession. From the beginning, they said it was possible while most participants in the market believed otherwise. Yet, as we are near the end of the Fed’s rate hikes, it looks more likely that we have evaded a hard-landing and expect a shallow and light recession given the current data.

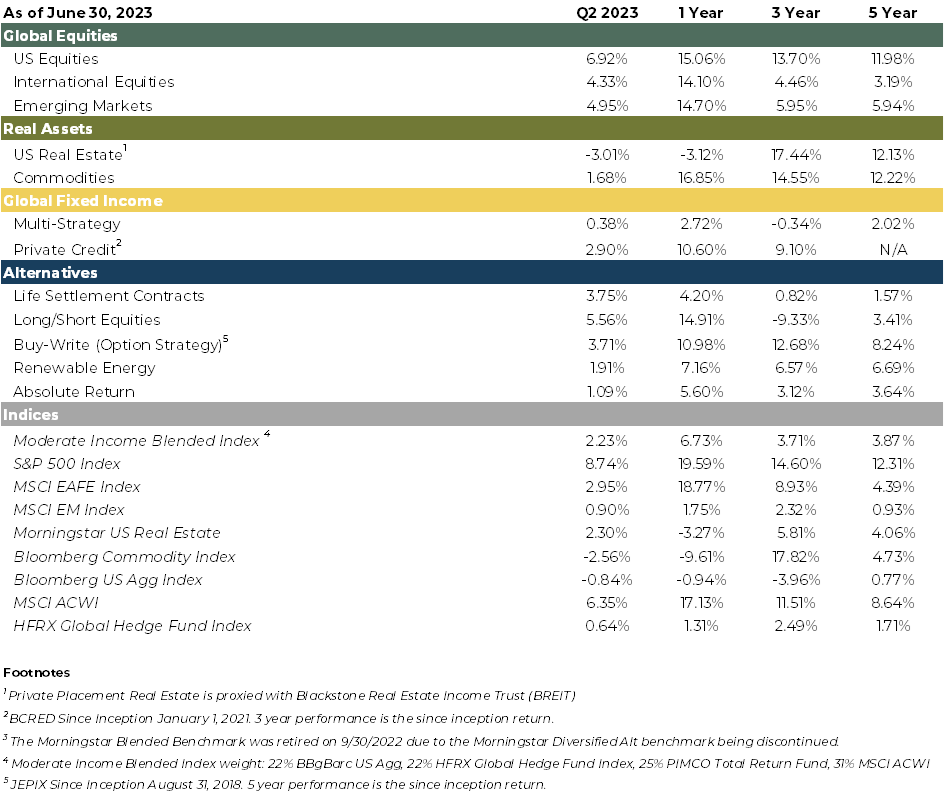

2q2023 Performance Summary

Summary

All things are moving as expected and we believe we are near terminal interest rates. Disinflation is underway and a brief global slowdown is occurring, but markets are likely to soon look past this slowdown and begin to look toward a future economic recovery. I will caution that should the if Fed feels its fight against inflation must contain rising unemployment, all bets are off on a soft yet bumpy landing.

Respectfully,

Leslie, Matt, Ryan, Ashlee & Katherine