SECOND QUARTER ECONOMIC OUTLOOK – April 12, 2024

state of the world

by LESLIE CALHOUN, President and CEO and MATT McMANUS, M.A., CFP®, Wealth Advisor and COO

As we move through 2024, the current macroeconomic environment is challenging as we contend with domestic political issues, the larger geopolitical conflicts, and the Fed’s impact with the current rate environment. That being said, the American economy and country has always proven itself to be resilient and we believe that resilience will hold. The upcoming presidential election is sure to be one of the most challenging elections that we’ve ever seen, yet the turmoil that might come about will be limited by the likelihood of a mixed government made up of both parties. Having split control and the resulting necessity of bipartisanship helps suppress extreme ideas that have been discussed in the past such as taxing unrealized capital gains. The Supreme Court has also shown itself to be a steady hand that will provide underlying support in whatever conclusion comes about. We have seen the resilience in the market despite these challenges, as shown by the fact our government debt rating has been downgraded by multiple agencies but yet we continue to be the preferred world reserve currency and our dollar continues to outperform most other currencies. We will face additional challenges no matter who takes the election, and yet despite all the headlines and the leadup to the election, the market performance over the last 6 months has shown that it is able to look beyond just one election cycle and is more focused on long term trends.

Our continued challenges with the geopolitical issues will also create vulnerabilities and opportunities. War is typically a profitable enterprise, especially for the American economy. As of now, the conflicts in the middle east and Ukraine have increased government spending, but this has in turn created tremendous growth in the energy, aircraft, and weapons industries. Our oil and natural gas industries who are now producing a surplus of supply has allowed us to become net exporters. Subsequently because of the shipping issues in the Red Sea, that has caused Europe to look to us for their energy and food supplies from the United States which increases profits here. In addition, China’s continued isolation economically has assuaged fears of the yuan taking over as the world’s reserve currency and their internal turmoil has also lessened the likelihood of an assault on Taiwan. Furthermore, as a result of Covid and the political issues with China, the idea of manufacturing locally has been reignited and has already resulted in us shifting our supply chains to be more resilient by relying on close neighbors like Canada and Mexico. This further insulates us from geopolitical issues which is also why the markets in general have shrugged off the conflicts to date.

In our opinion the Fed is currently the largest risk in the market, and that risk is beginning to fade as the likelihood of rate cuts becomes closer and closer. We have had affirming data for the last 8 months, save a couple bumpy CPI reports, that inflation is continuing to drop. Wage growth has stopped, unemployment has begun to rise, and consumers are losing purchasing power because of the rate environment. This will cause the Fed to have to act and reduce rates in order to prevent a more significant slowdown. As the Fed begins lowering rates, whether its in June, July, etc.. this will release a tremendous amount of money on the sidelines and into the market. Although getting a 5% relative risk free rate of return in a money market or CD is helpful in the short term, the necessity for higher returns over the long run will cause market based investments to outperform cash/money markets despite short term volatility. This has been true of every Fed rate cycle and will provide a significant opportunity in the next few years.

Our portfolios are heavily diversified with investments in primarily domestic equities, fixed income, private credit, longevity contracts, multiple real estate sectors, and in alternatives that profit in volatile markets. These diversified investments have been integral to providing steady long term returns, despite the chaos in the wider market that we have experienced in the last 5 years with Covid, the 2022 market, and a banking crisis. Our disciplined and diversified investment strategy has provided stability in the past and we believe will continue to do so even now in the face of the current challenges we all face.

estate planning for A future lower rate environment

by MATT McMANUS, Wealth Advisor and COO

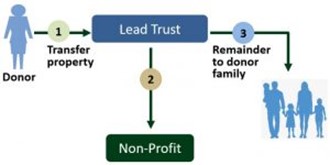

With estate tax legislation potentially changing again in 2026, it’s important to continue to consider ways to exclude assets from potential estate tax. If you are charitably inclined and want to place an asset in trust for your children or other beneficiaries, but don’t personally need or want to draw an income stream from it now, you may like the idea of that asset providing an income stream to a charity instead. This is where a Charitable Lead Annuity Trust may make sense as interest rates come back down.

Here’s how the CLAT works. You first set up a trust and, working with your advisors, decide on the number of years for its term, set up an investment plan, and calibrate the rate at which the trust will pay an annuity stream to your chosen charity. If you plan well and your investments cooperate to the degree that the investments are able to outperform the rate at which they are being annuitized for the distribution to charity, the potential exists to leave a tidy sum to your beneficiaries but without exhausting your lifetime gift tax exclusion.

When evaluating the CLAT strategy, you have two different primary types of CLATs, Grantor and Non-Grantor.

Grantor CLATS provide an income tax deduction equal to the present value of the gift to charity. This will often equal the value of the assets contributed, subject to an annual 30% of AGI limitation. However, the income from the trust for its life is taxable to the grantor, including capital gain on any sale of assets contributed to the CLAT.

Non-Grantor CLATs on the other hand provide no charitable deduction, but the income generated during the trust period is taxable to the trust, which can deduct the amount of the annuity payment to charity each year and as a result the grantor pays no income tax. This can be a valuable strategy if you would like to lower your current income taxes while having a high growth investment strategy to maximize the eventual assets that pass to your beneficiaries outside of your estate.

A key to success with this strategy is a low 7520 rate. This is an interest rate set monthly by the IRS and mirrors the Federal Funds rate.

This rate matters because the IRS will use it to determine, in the present, the gift tax on the future gift to your children/beneficiaries. In doing so, the IRS does not care what level of assets will in actuality one day remain for them. Instead, the gift tax benefit is based on a present value calculation of the annuity that will be paid to the charity over time, less a discount factor determined by the 7520 rate. The lower that rate, the lower the discount factor, and therefore the higher the IRS will value the charitable gift. If planning and circumstances allow, that value can be high enough to show a zero-remaining gift to your children. This is sometimes referred to as a “zeroed out” CLAT.

As the Federal Funds rate is currently at a high not seen since the early 2000s, this is not necessarily the right time to put the strategy in play, but as those rates come down later this year and next, it may become a more viable strategy to consider.

EXAMPLE

As an example, a mother and father have decided to create a $5 million CLAT to last 25 years. It will pay an annuity to their favorite charity of just under $240,000, and all remaining assets in the trust, when its term ends, will go to their children. Assuming the trust could earn 7% on invested assets, there would be more than $13 million distributable to the children, free of transfer tax. This is because the discounted present value of the total annuity payments to the charity matches the original gift to the trust, thanks to the low 7520 rate. Again, a “zeroed out” CLAT. That ability is the power of this technique. If the 7520 rate had been 6% as opposed to the current 0.80%, in order to achieve the tax-free transfer, the total gifts to charity would have to have been over $390,000 per year and just under $2.4 million would be left to distribute to children.

For illustrative purposes only; not a forecast or promise of investment performance, but an example of the impact of a trust strategy under different interest rate scenarios.

As of today, the 7520 rate is 5.2%. Although now may not be the time to enact a CLAT strategy, as the Federal Fund rates come back down in coming quarters it is worth considering the impact this may have on your estate and your charitable giving. In coordination with you estate planning attorney we can help design an investment portfolio that can provide both for the income distributions for the charities today and the growth objectives to provide assets for your beneficiaries in the future. If the idea of “doing well by doing good” appeals to you, this strategy might be just the thing.

Data Centers – The New Digital Real Estate

by RYAN THOMASON, CFA, Portfolio Manager

There are approximately 29 billion total devices and 14.7 billion Internet of Things (IoT) connections in our world today, encompassing a wide array of devices such as autonomous cars, PCs, TVs, smartphones, and more. Globally, the proliferation of devices and connections is outpacing both population growth (1% compound annual growth rate) and the expansion of Internet users (6% compound annual growth rate), with a rapid 10% compound annual growth rate. This surge in connectivity is largely fueled by consumer demand for data, which is evident in various sectors including the shared economy (i.e., ridesharing, food delivery), cloud computing, social media, video streaming, gaming, and the Internet of Things (i.e., home security, smart appliances, wearable health devices). Our insatiable appetite for data shows no signs of abating. The infrastructure supporting this data-driven ecosystem is often overlooked but indispensable: data centers.

A data center is a specialized facility designed to house servers, storage devices, switches, routers, and fiber optic transmission equipment crucial for the daily operations of both consumers and businesses. These centers serve as the backbone of the modern digital age, providing the necessary infrastructure for storing, processing, and distributing vast volumes of data. They are utilized by major corporations in all types of industries around the world, and we are now witnessing even more demand due to the widespread adoption of generative artificial intelligence (AI).

The data center industry is experiencing a rapid growth phase, poised for significant expansion in the coming years. Projections indicate that within the next five years, the volume of data generated by both consumers and businesses will double, surpassing the cumulative data created in the preceding decade. In response, the total storage capacity across data centers and endpoint devices is expected to increase from 10.1 zettabytes (ZB) in 2023 to 21.0 ZB by 2027, reflecting an impressive five-year compound annual growth rate of 18.5%. Further fueling the demand for data and processing power is the adoption of generative AI, which is anticipated to revolutionize the data center landscape. The impact of AI extends beyond mere numerical growth, influencing not only the quantity but also the design and geographic distribution of data centers. Bloomberg Intelligence forecasts an impressive growth trajectory for the AI market, projecting a surge to $1.3 trillion within the next decade from a modest $40 billion in 2022. Additionally, JLL reports that by 2025, half of all data centers will be dedicated to supporting AI programs. These forecasts are already manifesting in the current market landscape, signaling heightened demand and a transformative trajectory for the data center industry.

The market has experienced an impressive 19.2% year-over-year growth in supply, reaching a construction peak of 2,287.6 MW. This growth trajectory is further exemplified by the 25% increase in construction projects and a robust preleasing rate of 73.1%, indicating proactive measures by businesses to secure data center space. The market’s resilience is further evident in the strong absorption rate of 468.8 MW and a low vacancy rate of 3.3%, with Northern Virginia boasting an exceptionally low rate of 0.94%. Lease pricing has observed a significant 7.2% increase, averaging $147.81 per kW/month. Moreover, given the substantial investment required from the tenant, renewal rates on leases typically exceed 95%.

We believe that the data center industry presents a compelling investment opportunity. Together with the investment sponsor, we intend to acquire well-maintained and strategically located commercial digital infrastructure, encompassing data centers, switch sites, and other technology-related real estate assets. These properties offer a combination of steady cash flows from operations and the potential for capital appreciation. The Fund we aim to invest in targets individual asset sizes ranging from $10 million to $100 million, ensuring diversification across tenant mix, asset size, lease term, and geographic location within the United States. Our objective of enhancing portfolio value will be pursued through various strategies, including implementing rent escalators, negotiating lease increases, utilizing modest levels of leverage dependent on interest rate levels, and executing value-add initiatives. By utilizing these strategies effectively, we anticipate strong returns for investors.

The data center market has historically been a stable market, remaining resilient even amidst significant economic downturns such as during the Great Financial Crisis and the COVID-19 pandemic. While many industries struggled during the pandemic, data centers experienced sustained growth. Although investing in a high-growth sector entails inherent risks, many of these risks can be mitigated through thorough underwriting and thoughtful deal structuring. For example, many of the targeted tenants will be investment-grade rated Fortune 500 companies, locked in to NNN leases with annual rent escalators, providing an effective hedge against inflationary pressures. Moreover, data centers are considered mission-critical infrastructure, essential to a tenant’s success and typically serve as a key asset in their revenue generation activities. Furthermore, despite reaching all-time highs in development, there remains limited supply in the market. This scarcity is attributed to factors such as the increased demand propelled by AI and challenges in obtaining lending for speculative data center development projects.

As we navigate an era defined by unprecedented digital transformation and data-driven innovation, the significance of data centers and other mission-critical real estate cannot be overstated. We believe that by building a portfolio of high-quality digital infrastructure assets that exhibit low correlations to the broader market, investors can earn strong risk-adjusted returns amidst evolving economic conditions.

Respectfully,

Leslie, Matt, Ryan & Ashlee