SECOND QUARTER INSIGHTS – May 16, 2025

PERCEPTIONS – abstraction or contraction

by LESLIE CALHOUN, Senior Partner and CEO

When I look back on the first quarter of 2025, I am reminded of a Jackson Pollack masterpiece, but I can’t tell you which one because I get them all confused. Pollack was a famous painter who revolutionized Abstract Expressionism by pioneering the “drip” technique in painting, whereby he poured and splattered paint to large canvases laying on a horizontal surface such as the floor. His artwork emphasized emotional expressionism and non-representational forms. His work, particularly the drip paintings, epitomized the movement of abstract expressionism’s focus on spontaneity and the artist’s personal experience.

The first quarter 2025 has brought so much flux and disruption it’s impossible to focus on one point or policy. We started on a positive note, with the S&P 500 hitting a record in February. We had moderating inflation and stable but ever so slightly deteriorating employment. Then the new administration’s unrelenting barrage of policy proposals, executive orders and a cost cutting through DOGE that was culling workforces and programs. To keep up, you had to become addicted to the newsfeed and social media 24/7.

The US economy thrived last year during stable employment and gently receding inflation enabling the Federal Reserve to lower interest rates three times in 2024 for a total reduction of 1.00%. Then President Trump took office in late January and the first tariff shots were fired when he announced 25% tariffs on Canada and Mexico. This was followed by additional tariffs on Chinese imports above pre-existing levels and a Presidential Memorandum ordering a review of “non-reciprocal trade practice(s).” Businesses took note and rushed to build inventories ahead of potentially rising import costs. Then came “Liberation Day” on April 2nd when the President announced a 10% global tariff on all imports and higher, seemingly haphazard rates, on 57 specific countries where trade imbalances are most amplified. The randomness and scale sent the S&P 500 down more than 10% over the following three days. Yet the worst of the negative reactions happened seven days following Liberation Day when our US Treasuries sold off at a rate not seen since the Global Financial Crisis and our US Dollar dropped precipitously. This seemingly caught President Trump’s attention, and he announced a 90-day delay on many tariffs with the exception of China. The ensuing volatility has increased as the tariff “goal posts” are moved day after day, hour after hour, with modifications, delays, carve-outs and even additional tariffs.

We now see this caused a contraction in US GDP in the first quarter, mainly because imports grew even larger than typical in order to front run the impacts of tariffs. We know from our experience during Covid that supply chains are globally connected and complete dependency on them is unwise, yet it has reduced the costs of many goods we use every day. Onshoring manufacturing is the ultimate goal, but it is not achieved at the flip of a switch and will cause scarcity and inflation. As consumers spend less, profits from companies fall, forcing those companies to cut costs by laying off workers. This will result in higher unemployment. This combination makes the job of the Federal Reserve difficult – to foster maximum employment and price stability. The Federal Reserve uses monetary policy to react to negative changes to their dual mandate. Monetary policy is either loosened or tightened by adjusting interest rates. Lowering rates eases credit and supports employment, while raising rates curbs inflation and slows the economy. The data today is pointing to lower employment and to likely higher inflation; opposite problems limiting what the Fed can achieve without inflicting harm to the other side of their mandate. Without strong data to point them in a direction, the Fed is likely to leave interest rates unchanged.

Looking at the US, Developed Markets, or Emerging Markets, a global trade war will slow all economies, but each region’s slowdown will start from a different point. Interest rates and employment levels are not equal worldwide. And in an instance of declining trade with the US, countries can make agreements not to include the US in some trading and offset the impact of our tariff penalties.

Falling oil prices, while helping to temper inflation worldwide, are reflective of heightened concern over a worldwide economic slowdown. A falling US Dollar against other currencies is even more of a conundrum as tariffs should have strengthened it and it is yet to be determined as the exact cause. The effect of such decline does worry us that the US Dollar and our US Treasuries are not seen as the bastion of safety as we witness the Swiss Franc, the Japanese Yen and other currencies appreciate against our currency. We are following this closely.

Whether these tariff announcements will ultimately be used as a negation tactic by the administration or will be made permanent, we don’t know. What we are more certain of is that we can’t expect much smaller economies like Vietnam, for instance, to have the wherewithal to have balanced trade with a nation the size of the US. We also cannot grow our own avocados, bananas and coffee, or mine the active pharmaceutical ingredients (APIs) which are essential components in many prescription and non-prescription drugs. We cannot simply flip a switch to produce parts, components, equipment and natural resources at the clip we consume. Building the infrastructure required to even consider nationalizing our consumption will require steel, lumber, concrete and materials we cannot source without either trade agreements or a hefty price tag. Blindly hoping for trade agreements here.

tariff uncertainty on markets

by RYAN THOMASON, Portfolio Manager

April was one of the most volatile months in history as markets reacted to tariff announcements. The VIX jumped to a high of 50 intraday (last seen during the pandemic) and the S&P 500 fell as much as 12% during the month. However, the index quickly rebounded over the month, nearly retracing all losses since April 2nd. Recent data showed that the economy shrank slightly in the first quarter as companies stockpiled imported goods ahead of new tariffs. While bond and international stocks were also volatile, they both contributed positively to diversified portfolios, adding as a reminder of the importance of staying invested and diversified through times of uncertainty.

April demonstrated the importance of being prepared for market uncertainty. The month began with the White House’s April 2 tariff announcement (dubbed liberation day) on nearly all trading partners. These tariffs were far higher than investors had expected, leading to fears of rising inflation, a global economic slowdown, and a trade war. Stock markets around the world reacted with the sharpest declines since the pandemic.

The administration’s decision just days later to implement a 90-day pause for most counties helped fuel the initial stock market recovery. Additional exemptions on China further calmed investors’ nerves.

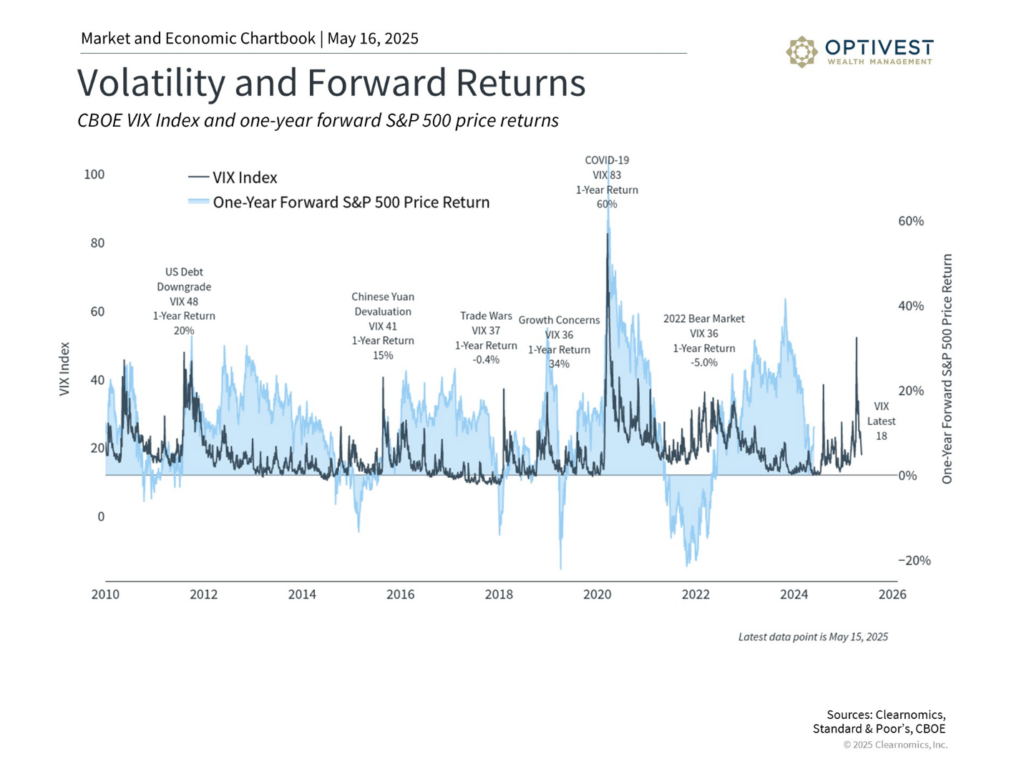

Stock Market Volatility

The chart below shows that VIX index, often referred to as the “fear index”, briefly crossed 50 for the first time since the pandemic. The VIX measures how much the stock market is expected to fluctuate in the near future. When it’s high (levels between 20-30), it means investors expect big swings (more uncertainty or fear). When it’s low (levels between 15-20), it suggests calmer markets. Many of the largest declines throughout April were followed by significant rebounds, serving as a reminder that market swings can move in both directions, and trying to time these moves can often be counterproductive.

While the markets have stabilized somewhat, uncertainty remains and many of the drivers of April’s volatility will continue to be in focus. The situation around trade policy is still evolving, although the 90-day pause suggests that the worst-case scenario may be less likely. We expect tariff headlines to continue to drive volatility in the near-term.

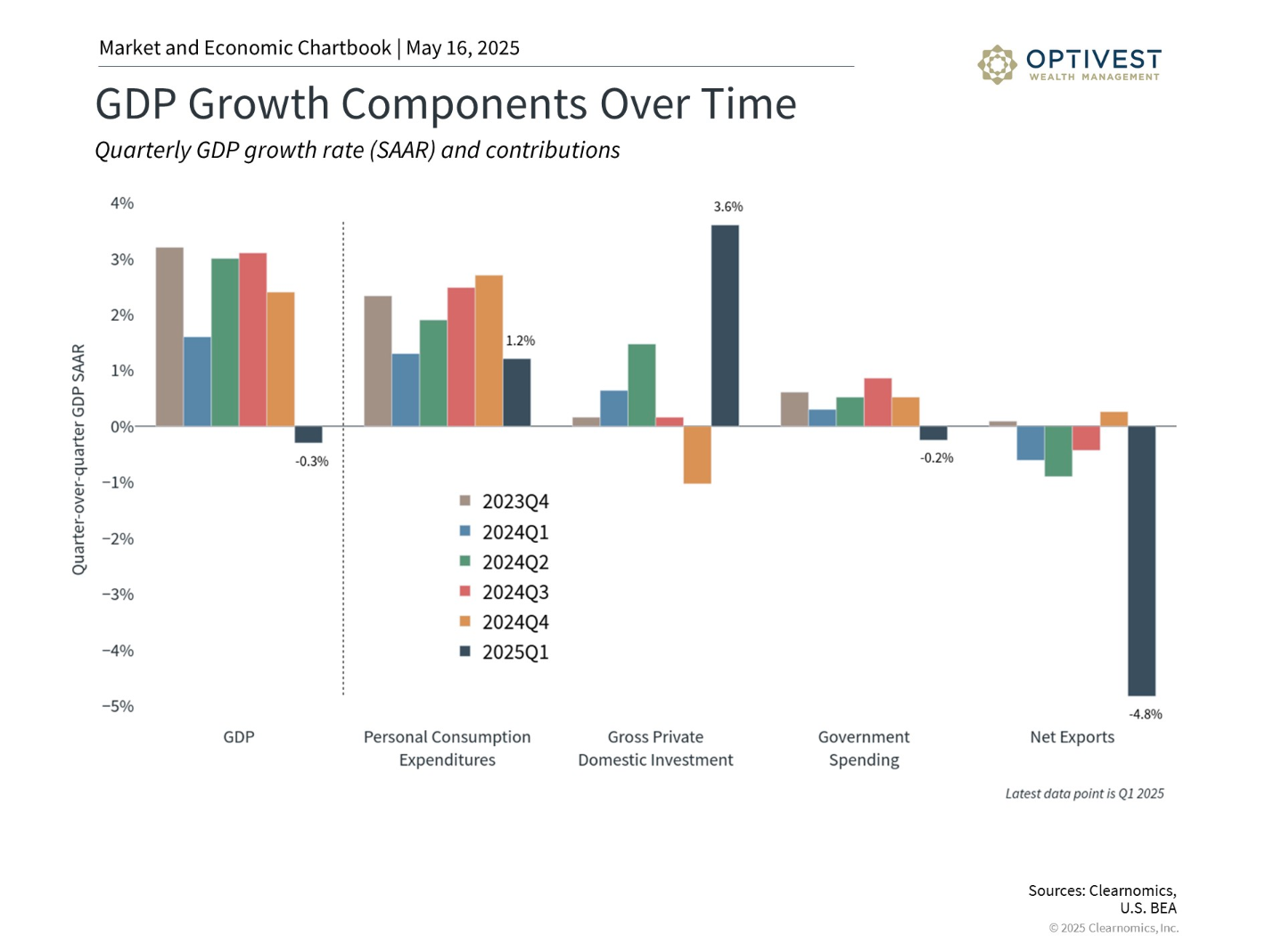

GDP Decline

One of the key concerns among investors is whether tariffs will drive inflation higher and growth lower. The latest economic reports show that the economy shrank slightly in the first quarter, with GDP declining by 0.3% over the period. This was the first contraction we have seen since early 2022. As shown below, this was almost entirely due to trade as businesses accelerated their imports to stockpile inventory. Consumer spending slowed but remained positive.

In recent years, consumer spending has been a key driver of economic growth. The latest surveys show that consumers expect a rapid acceleration in prices over both the coming year and in the long run, resulting in historically low consumer confidence. While this has not yet impacted consumer spending or inflation in a significant way, it could be an important factor in the coming months.

The mixed picture on economic growth and inflation also makes the Fed’s job more difficult. Not only does the central bank face challenging interest rate decisions in the coming months, but its independence was briefly called into question by the White House, driving further market volatility and uncertainty. At the moment, markets expect the Fed to cut rates about four times this year, with the first cut occurring in July. These predictions change on a constant basis due to evolving economic data, central bank signals, and global events. But they are important as these expectations move the stock and bond markets.

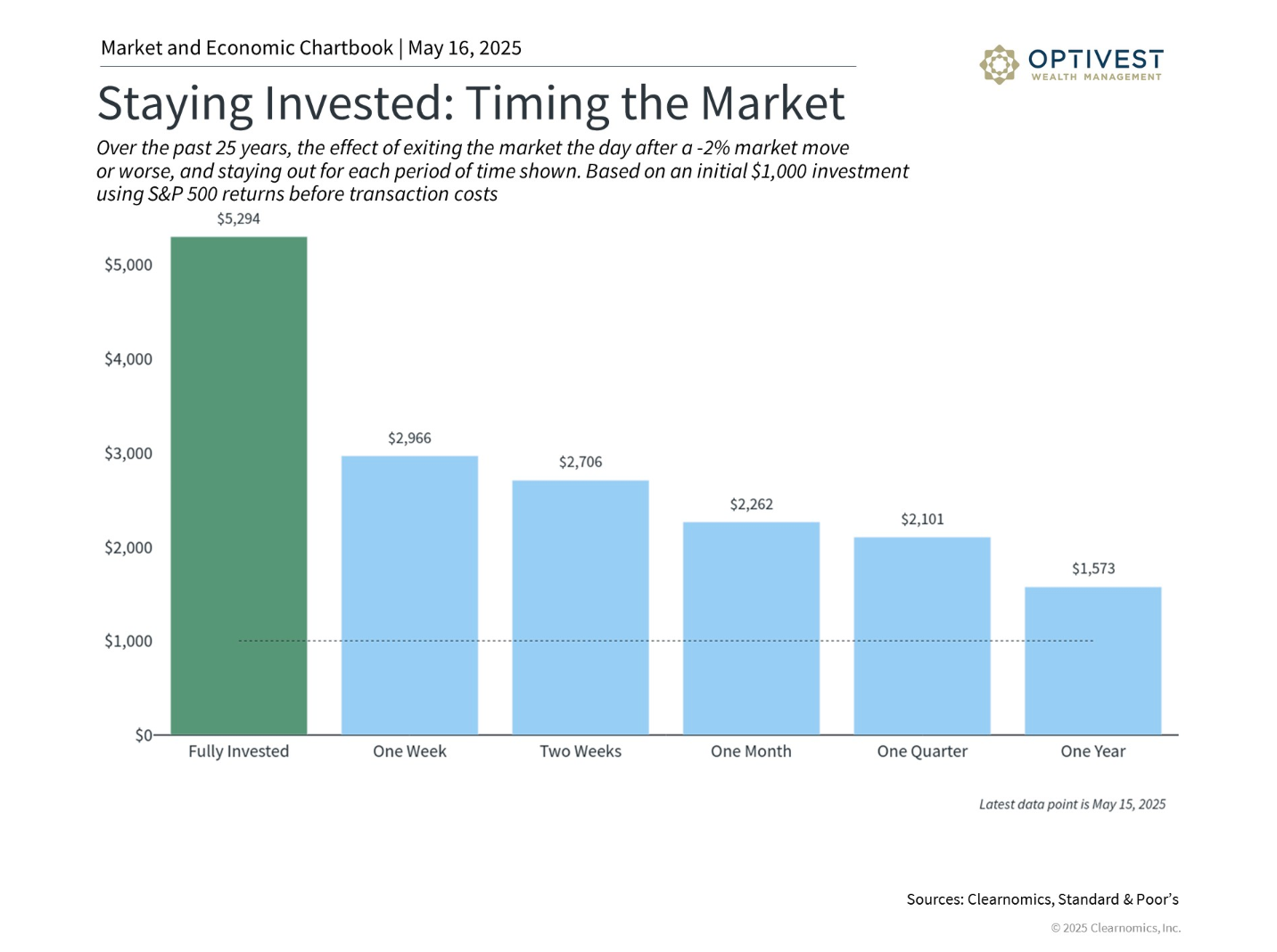

Staying Invested

In the face of recent challenges, one investment principle remains clear: staying invested through periods of volatility has historically been an important path to long-term financial success. The chart below shows the effect of exiting the market for different durations of time immediately after -2% market days. Deciding when to re-enter is difficult and often results in worse performance than simply staying invested in the first place. Rather than selling equities and holding cash, we believe a more prudent approach in times of heightened volatility is to rebalance your equity exposure. An example of this is selling high growth, low earnings companies and buying high cash-flowing, quality-oriented companies that have defensive characteristics.

While increased volatility can be unsettling, it’s in times like these that focusing on your financial plan, portfolio construction, and areas of opportunity is most important. Market volatility often results in attractive valuations across many asset classes, offering potential opportunities for those in search of greater diversification and balance in their portfolios. The S&P 500, for instance, has seen a significant improvement in its price-to-earnings ratio this year. The market volatility we have witnessed over the past month should serve as a reminder that short-term market swings can occur without notice. History repeatedly demonstrates that disciplined investors who focus on their long-term financial plans will be better positioned to achieve their goals.

Respectfully,

Leslie, Matt, Ryan & Ashlee