FIRST QUARTER ECONOMIC OUTLOOK

Company Update

by LESLIE CALHOUN President and CEO

Over the past several years, Optivest experienced record growth due to our ability to attract high net-worth clientele and talented, experienced professionals. Yet the end of December brought the close of an era with the retirement of our founder, Mark Van Mourick. Mark’s imprint is forever on the firm. We step into this venture with the same spirit of providing our valued clients with diversified, durable, and vetted institutional quality investment access and portfolio management as well as a culture of integrity and respect. In the spirit of existing to serve, Optivest will proudly continue support of charitable giving through the Optivest Foundation now part of Optivest Legacy. We thank Mark for guiding us to this launch point and we look forward to continuing to serve our community and world and most importantly, you, our valued clients and friends.

U.S. & World Economy

by LESLIE CALHOUN President and CEO

The 4th quarter of 2018 brought volatility back and sent world stock markets tumbling. The S&P 500 ended 2018 in the red for the first time since the end of the global financial crisis of 2008. 2018 was a year when cash outperformed a 60/40 portfolio. There are many factors to blame for the market movements and the most regularly cited are the trade war between the U.S. and China and slowing worldwide growth. The political drama didn’t help with a lame duck U.S. Congress and then a start of 2019 with a Federal government shutdown. To further add pressure to markets, the Brexit uncertainty and European Central Bank beginning to ease asset purchases drove additional negativity. As if the other pressures mentioned above weren’t enough, algorithmic trading drove further volatility and exacerbated price swings, particularly when those types of trades now make up close to 90% of stock market trading (algorithmic trading is a process of automated computer programmed trading accounting for factors such as time, price and volume).

While our stock markets tumbled, our depressed bond markets have shown some vitality and have stabilized after a second half of the year sell-off related to the Fed tightening monetary policy and raising rates. Language from the Fed has recently become more dovish and forecasts now call for only two rate hikes in 2019. At home, labor markets are strong, holiday sales were up 5% year-over-year and inflation is unremarkable still.

Although the volatility in markets may seem new, a Goldman Sachs study shows that since 1928 the incremental daily price moves in the S&P 500 we experienced last year are actually not far from historical average.

The risk of a recession on the horizon? The 2008 financial crisis was a function of massive housing debt, risky investment instruments tied to that debt and a heavily over-leveraged global financial system. We don’t see extreme excesses like those in our current environment but massive dislocations like a sustained government shutdown could create enough upheaval to speed a recession ignition.

Financial Planning

by BART ZANDBERGEN, CFP® Senior Wealth Advisor

I hope everyone had a wonderful holiday season. Whether you reached your personal goals in 2018, faced challenges or are looking for a 2019 reboot, let’s take a moment to hit on the key themes from the past year.

My Thoughts

When I was in my 20s and 30s, I wouldn’t blink at a stock market decline. The contribution rate of my 401(k) was on autopilot. Each pay period I’d purchase well-diversified mutual funds.

When stocks declined, dollar-cost averaging allowed me to purchase a greater number of shares. Besides, I knew it would be decades before I’d need the funds for retirement.

With a very long-term time horizon, even a vicious bear market wasn’t an issue.

As we age, we can’t take such a sanguine view, and a more conservative mix of investments becomes paramount. Though we are unlikely to match major market indexes on the way up, we can still anticipate longer-term appreciation and sleep at night when the unpredictable market sell-offs materialize.

For those in the most conservative portfolios, the drop in the major market averages had little impact on your overall net worth.

Our recommendations are based on many different factors, including risk aversion. It’s rarely profitable to make decisions based on current market sentiment, i.e. panic selling or euphoria that sends us chasing the latest trends.

We know that stocks can be unpredictable over a shorter period and sell-offs are normal and they aren’t pleasant. But we take precautions to minimize volatility and more importantly, keep you on track toward your long-term financial goals.

Stocks will hit small bumps in the road and occasionally hit a major pothole, but the long-term data highlight that stocks have easily outperformed bonds, T-bills, CDs, and inflation. As Warren Buffett opined a couple of years ago, “It’s been a terrible mistake to bet against America, and now is no time to start.” (Investment U, Motley Fool).

I hope you’ve found this review to be educational and helpful. Let me emphasize again that it is our job to assist you! If you have any questions or would like to discuss any matters, please feel free to give me or any of my team members a call. As always, I’m honored and humbled that you have given me the opportunity to serve as your financial advisor.

As 2019 gets underway, I want to wish you and your loved ones a happy and prosperous new year!

Portfolio Management

by STELLA CHOI, CFA®, CFP® Director of Portfolio Management

When looking back at the markets for 2018, global equity markets had been in a very challenging environment as a result of increasing volatility. In the 4th quarter of 2018, U.S. equities and global small-cap equities were among some of the lowest performing sub-asset classes for the quarter. Nonetheless, U.S. equity securities ended with only modest losses on a one-year basis, as a result of all of the previous gains earlier in the year. In a market environment like this, three-year total returns should be kept in mind as certain sub-asset class returns may perform negatively in the short term, but yet when considered over a longer timeframe, may still be providing positive growth.

In reviewing our model allocations for 2018, one notable change to the model last year was consolidating what was separate European and Asia Pacific regional securities into one combined Developed International Equities sub-asset class. Year-to-date all of the global equity returns are rebounding very strongly from their 2018 lows.

In addition, the Global Fixed Income asset class was a mixed story for the 4th quarter. The fixed Treasury positions had the most positive story for the fourth quarter with a positive return for the year. While at the same time, floating and preferred rate positions during the 4th quarter gave away most of their returns for the year.

Overall, most market sectors experienced a directionally similar story to the Global Equity landscape in 2018. However, public real estate and gold were an example of the positive performing sectors for the fourth quarter of 2018. Although missing from the model chart below, the illiquid Real Estate Partnership (LP/LLC) class experienced positive returns for 2018 and helped give some buffer to the falling global equity returns.

Alternative funds also helped to hold portfolio returns from falling. Most of the alternative funds ended positive when looking at a 1-year return. Those funds that were negative, had a very modest negative return when compared to traditional equity sectors. Also not listed on the chart below, the Life Settlement funds also provided positive mid-single-digit returns for the year. Overall, Alternative funds did their job and helped mitigate some of the market downside.

In addition to the changes above, at the end of 2018 we reviewed all of the equity positions in the taxable accounts to determine if there were opportunities for tax loss harvesting activities and took action where appropriate. The tax loss harvesting technique will continue to be incorporated throughout the year whenever the opportunities are presented in the market. We will also continue to perform mutual fund capital gains distribution management, to maximize the after-tax return and minimize any tax effects.

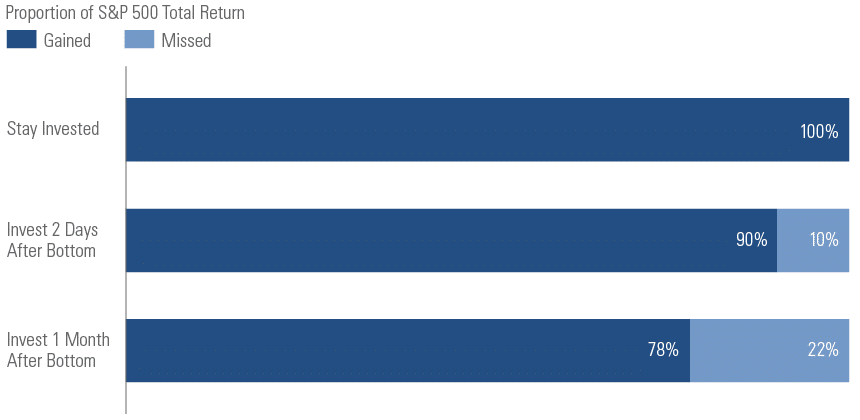

While investors might be tempted to radically rebalance their investments or even move entirely to cash during periods of volatility, trying to miss the bottom is costly. According to the study done by Bloomberg and GSAM (Goldman Sachs Asset Management), some of the markets strongest returns have come within days of a bottom.

From the S&P 500 low Christmas Eve 2018 through Friday 01/11/19, the S&P 500 had already risen 10%.

Besides potentially avoiding taxable capital gains or locking in losses of capital, staying the course with a diversified portfolio has tangible rewards.

We are also delighted to announce that Matt McManus, CFP® has recently joined Optivest as a Wealth Advisor and our Chief Operations Officer.

Matt will be responsible for providing Financial Planning and Wealth Management advice to clients of the firm. With a passion towards ensuring each and every client receives concierge level service and support, Matt is responsible for ensuring that Optivest’s day to day operations are run with the utmost attention to detail. By utilizing the OptiWealth Platform, Matt is also able to provide cutting edge Financial and Estate Planning strategies with Optivest clients to help optimize their financial legacy. We invite you to seek out Matt or any of our team if you believe our services could be of value to you.

Happy New Year!

Leslie, Bart, Stella, Letitia & Matt