Market Changes – New Horizon

March 26, 2020

It seems we are in the season of breaking records. From severe daily market movements both to the upside and downside along with now record breaking unemployment, each day seems to bring new unforeseen changes. Along with the extreme measures being taken to combat the disease’s spread, we are all experiencing a new sense of isolation. While importantly prioritizing human health, we have in turn had to shut down large swaths of the economy, closing schools and businesses and limiting human interaction. Having to do so makes it unfortunately clear that a global recession is at hand. Yet despite all the turmoil, looking outside of our country and this short period of time, the possible exit for some from all of this is starting to be realized.

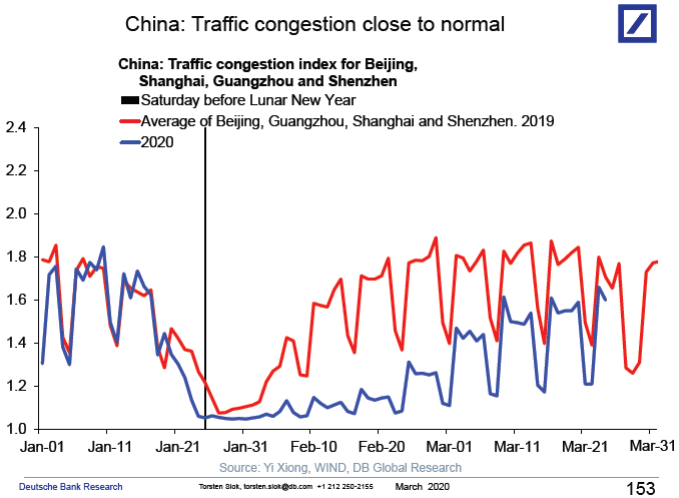

The initial impact of the virus in China resulted in their economy beginning a severe decline in late January. Yet with their extreme virus measures, two months later we have begun to see a rebound in key economic indicators such as home purchasing and transportation. Using this Chinese pattern for the US and Europe, we would hope to begin to see a rebound in the economic data for the US and Europe sometime in late April or May. An argument for a possible faster rebound is the aggressiveness of the monetary and fiscal response in the US and Europe. Albeit, an argument for a slower rebound is the lack of willingness in some countries to aggressively contain the spreading of the virus. Nonetheless we have seen a clear demonstration that we can get to the other side of this period of time.

For some time, we have been estimating the likely impacts of the virus’ spread through a number of channels, including reduced trade, restrictions in supply chains, tighter financial conditions, and, perhaps most significantly, social distancing measures. This latter effect is leading to a profound decline in consumer spending in the “face-to-face” sectors of the economy, namely hotels, restaurants, air travel, and related activities. We expect consumer spending in the months ahead to decline at the sharpest pace since at least World War II, with clear impacts to employment.

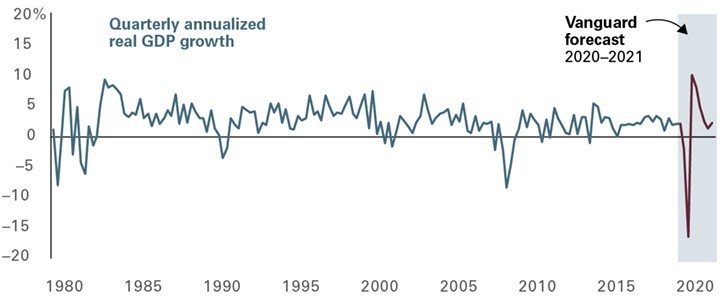

As shown in the illustration, real GDP is likely to contract in the coming quarter by nearly 17% on an annualized basis. This would mark the deepest quarterly decline since at least the 1950s. This will be a trying time for all of us, and certainly for the U.S. economy.

We expect, however, that this could also turn out to be among the shortest recessions in our history. Importantly, we assume that the need to significantly restrain activity, such as the closure of non-essential businesses, will dissipate by late in the second quarter. Under such a scenario, and with aggressive fiscal and monetary policy measures, we would foresee a rebound in growth in the third quarter to mark the end of this sharp yet short recession.

A ray of light is that, looking over the next ten years, our stock market outlook is starting to improve. The reason? The role that current valuations, which have contracted in the recent sell-off, play in our long-term forecast. Put simply, the price of most equities has become much lower than it had been, giving equities more room to grow before they reach what we’d consider to be their fair value. The theme broadly holds true for ex-U.S. equities. A similar dynamic also occurred in 2009, when the global economy was in a deep recession and stock prices were low.

We are by no means through this chaotic time. As domestic infection rates rise and the ripple of the closure of the US economy continues, we will continue to feel the impact of that in our daily lives. We are however on the eve of one of the largest fiscal stimulus packages to ever be passed and we continue to see new found ingenuity in both monetary and fiscal policy. We hold true to our philosophy that our diversified portfolios serve us in good times and bad, and over time we will see continued growth and a return to better times. We thank you for your trust in our guidance through these historic times.