SECOND QUARTER ECONOMIC OUTLOOK – May 12, 2022

Transition year

by LESLIE CALHOUN, President and CEO

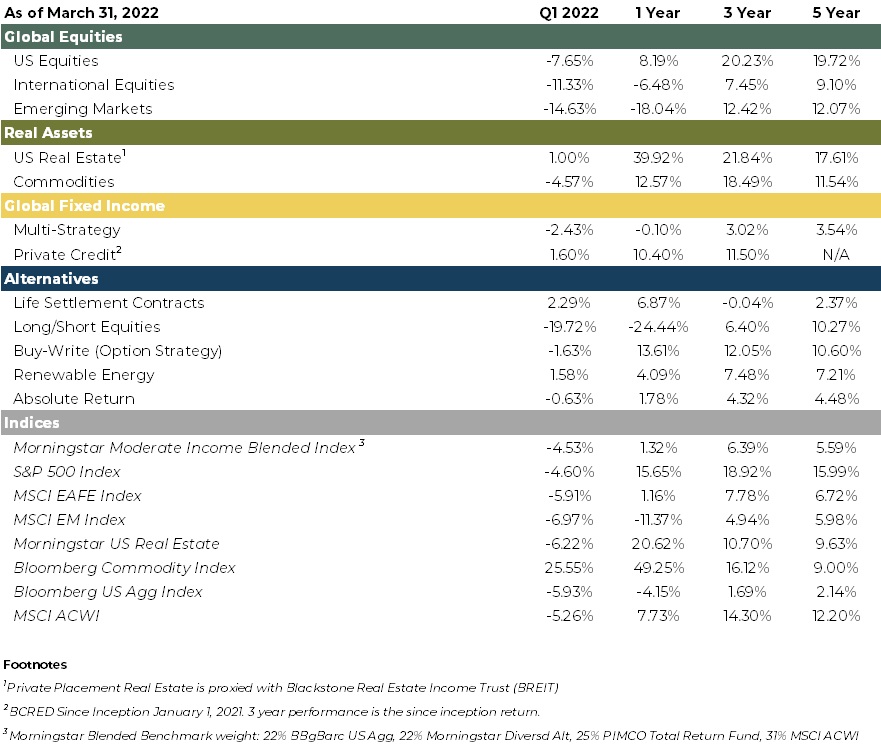

Most of the time, investors can be trend followers because business cycles typically last several years, with policy and economic drivers possessing long and lumbering tails. But occasionally the direction of long-term trends change, and the pivot wreaks havoc on portfolios positioned for the last war or the last bull market. Such is an apt description for markets in 2022 when investors have had to recognize not just the emerging endemic phase of COVID in the West, but the radical regime shifts accompanying it: fiscal and monetary tightening, global inflation unleashed by continuing supply shocks, empowered labor, underinvestment in CAPEX, and a new geopolitical environment set in motion by Chinese regulatory responses and Russian aggression. The result has been one of the toughest starts to the year for a stock/bond investor in decades. A repricing of rates, inflation, and risk has been at the heart of weak performance, with US Treasuries melting down more than 12% in the past six months and the S&P 500 and Nasdaq Composite down 16.59% and 25.8%, respectively, from their highs last year.

Stocks and bonds are falling in tandem at a pace not seen in decades leaving few places for investors to hide. Bonds no longer offer a hedge to holding stocks. This year’s declines have dealt a blow to the 60/40 portfolio model. While some investors are trying their hand at commodities exposure, this is a risky game. Commodities can fall as quickly as they rise. It was just April 2020 when US crude oil futures traded below zero meaning producers had to pay to get the oil they spent money to produce hauled away and stored. While we are having to adjust exposure to fixed income since the inevitable rate hike environment will continue to punish bonds, we feel there will come a point when inflation comes down and stocks will begin to rebound. What appears to be the end of a 40-year bond market rally is proving the end of the long hailed 60/40 investment model and is now demanding greater diversification to not just attain income but also de-risk portfolios.

There seems to be nowhere to hide yet real estate is still performing positively. Self-storage has been the strongest real estate class over the last decade and still plays a heavy role in many of our portfolios. The reluctance to build housing since the GFC (Great Financial Crisis) has led to the highest housing shortage ever and is driving and sustaining high prices and the threat of rising mortgage rates is driving a frenzy in some pockets. Buying power is falling so multi-family housing stands to be a significant beneficiary.

The US will onshore a lot of production and technology that was previously sourced in lower-cost economies of the world. The world will become more divided (nationalism) and become less reliant on unfriendly countries to provide products and resources and the US stands to benefit from this. Countries are showing reluctance to engage with China because of continuing lockdowns. Additionally, the US can become energy and some production independent but we have to first have the infrastructure in place to ramp up and this will take some time. The strong US Dollar is indicating our economic potential and the resulting higher inflation than we’ve seen over the last couple of decades as we onshore with higher costs involved. If we can achieve a soft landing and avoid a recession, we stand to have a shorter time of flat returns. If we see a hard landing and a recession, it would push investors to take greater risk to achieve the same returns and we would move to further lower risk exposure to focus on capital preservation until an eventual turnaround.

Europe will suffer because of its long-standing reliance on Russian energy and slow growth. China continues its zero-Covid policy, locking down cities and disrupting supply chains across the world. China also did not implement the monetary easing at the rapid rate that the US and Europe did so they are just beginning to fuel growth through rate easing and stimulus. Their different approach hasn’t proven more effective yet.

Income needs during a storm

by MATT MCMANUS, M.A., CFP®, Senior Wealth Advisor and COO

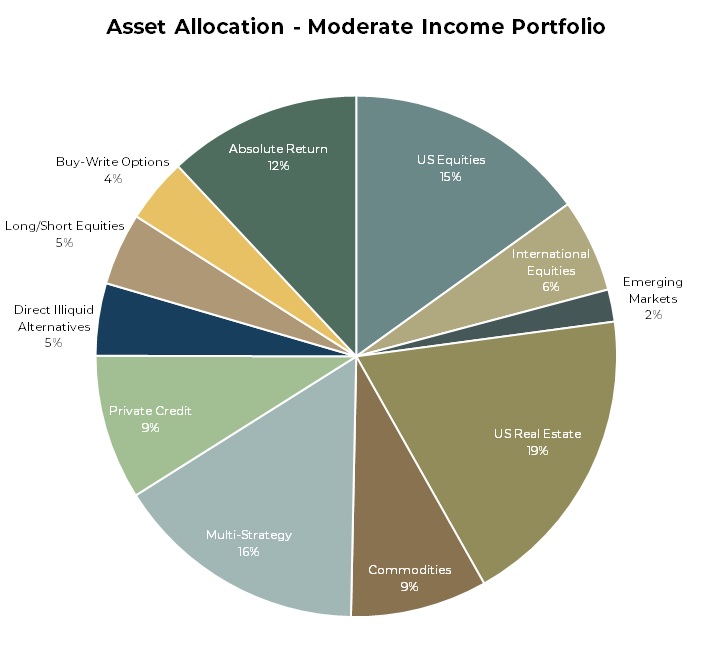

During periods of market volatility, active portfolio distribution plans should necessitate additional thought on the sources and timing of the funds raised. In general, once retirement distributions begin, they are supplemented from multiple sources. Those sources include interest, dividends, capital gains, and Real Estate income. Optivest constructs income distribution plans that balance out the tax effects of the sources of income while keeping a watchful eye on the portfolio asset allocation to ensure your portfolio continues to stay diversified and not overly concentrated in any one asset class. In times like this, as Real Estate incomes are still recovering from Covid and the market volatility makes us hesitant to sell positions that have paper losses but a great outlook, it is worth considering additional ways to meet your monthly or quarterly distribution needs. One such way is utilizing the pledged asset line of credit available through Schwab.

Pre-Covid, a majority of our direct Real Estate positions paid regular disbursements directly into our accounts on a reliable basis. Those investments done through a limited partnership structure allowed us to receive those income distributions with varying levels of tax deductions, thereby providing tax-sheltered income. During the initial Covid shutdown, many of our hospitality properties immediately ceased payments as it became clear and necessary to build up cash reserves with unknown longevity to the lockdown. We are happy to say each of our managers successfully kept their properties intact and operating, giving them a chance to take advantage of the reopening that has been occurring over the last 9 months. That being said, due to covenants from the financing on the properties, a number of the hospitality investments are just now beginning distributions and will have some catch-up work to do with regards to any preferred returns that are due to us as investors. Because of that freeze in income distributions we have seen lower than average Real Estate income distributions in the last 2 years. That being said, because the equity markets were on a tear, we were able to substitute any shortfall by realizing capital gains and then tax-loss harvesting at the end of the year to try to maintain the tax efficiency of the income being realized.

With the market volatility and the on-paper losses specifically in equities this year, our last resort would be to sell positions at a low price. As we wait for the Real Estate income distributions to continue to pick up, we are also recommending clients consider the use of the pledged asset line of credit (PAL) offered through Charles Schwab Bank. The program allows you to pledge any liquid investment (stocks, ETFs, most mutual funds) that we currently hold in our models, and you may borrow up to 70% of their value. This line of credit can only be used for individual, joint, or revocable trust accounts and the borrowing rates are favorable and allow for flexibility in how much you draw on the line. (Your first draw must be at least $70,000, however, after that you can take at any increment.) For those clients already utilizing the strategy, Optivest is actively paying the interest costs each month from the dividend and interest income that comes into your accounts to ensure the balance does not grow from borrowing costs. In the future, as capital is returned from your investments or as a Real Estate project goes full cycle, we can lump sum pay down any outstanding balance. Essentially, this strategy allows you the best of both worlds, remaining invested while our equities on paper are at depressed prices, and still being able to meet your income needs while waiting for all of the Real Estate income to come back online.

Without knowing the extent of the volatility we will continue to see geopolitically and in the markets, a PAL line of credit may make sense to meet a portion or all of your income needs. We anticipate our Real Estate investments continuing to appreciate in value, and for their revenues to recover so they can begin distributions to us regularly. In the meantime, we will continue to protect your portfolio and strive to manage volatility which your diversified and durable portfolios are designed to do. If you have any interest in discussing this strategy further, please reach out to us today and you can follow the link below to learn more about the Pledged Asset Line of Credit program and the current borrowing rates.

https://www.schwab.com/pledged-asset-line

Portfolio Management

Portfolio Management

by RYAN THOMASON, CFA, Associate Portfolio Manager

2022 Asset Class Outlooks

Equities

We are cautiously optimistic about U.S. equities. The economic backdrop is generally favorable, valuations have improved since the beginning of the year, and corporate earnings, while decelerating, are still strong. Lastly, equities have historically served as a strong inflation hedge, which we expect to remain elevated relative to historical averages. We do expect a volatile stock market in 2022 as the Fed raises interest rates to combat inflation, making active management and stock selection increasingly important.

Regarding styles, we see opportunities in both growth and value. At the beginning of the year, the Optivest Investment Committee saw growth stocks begin to underperform due to lofty valuations and high inflation readings. We decided to trim our growth exposure to have a more balanced portfolio to reflect our investment outlook. Today, we believe value will continue to perform in this high inflationary environment as well as quality growth stocks which now have attractive valuations coupled with strong earnings growth. The U.S. market will be challenged this year but we believe it is still worthwhile to stay invested until we see signs of an imminent recession.

Abroad, we are underweight in international developed and emerging markets. We believe Europe as a whole has a higher probability of falling into a recession over the next 12-18 months due to an increasingly hawkish European Central Bank (ECB), high inflation, and a potential disruption to energy supplies which would curtail economic growth. Looking to emerging markets and specifically China, we continue to believe there is significant growth potential in the long-term but acknowledge that the near-term is challenged which has led us to sit on the sidelines. We have seen China’s zero-COVID policy and associated lockdowns hinder growth and view their support of Russia as troublesome. Although China has very attractive valuations, the risk and uncertainty are too high.

Fixed Income

In the face of rising interest rates and high inflation, we are underweight duration and overweight credit. We believe this allocation will benefit from continued strong credit fundamentals and attractive valuations as a result of recent volatility. We are also introducing private credit and private real estate bridge-lending investments to client portfolios. Private credit offers great diversification benefits and is an excellent hedge to inflation because of its short duration and floating rates. Private real estate bridge-lending offers a unique opportunity to participate in direct real estate investments (primarily multi-family housing) at the preferred equity level, which offers more protection than general equity in the event of an adverse event. This investment type also offers short-duration and tax-sheltered income.

Real Estate

Private real estate investments have been relatively insulated from recent market volatility and we believe continuing economic reopening and strong capital flows should provide ongoing tailwinds. Private real estate offers many diversification benefits to portfolios and are especially attractive when taking into account their tax benefits. Many of the trends that COVID accelerated are continuing to favor many of our preferred property sectors such as multi-family, net-leased essential retail, and self-storage. We are also beginning to see hospitality gain momentum as COVID enters the endemic stage, business travel resumes and pent-up consumer demand leads to increased spending.

Alternatives

Many of our alternatives are either return-enhancing or offer diversification benefits through low correlations to public markets. While we have historically taken a balanced approach when investing in alternatives, today we are seeking opportunities that emphasize drawdown protection with a very low correlation to equity and fixed income markets. We are beginning to utilize market-neutral strategies that exhibit a negative daily correlation to broad-based markets. This investment will dampen portfolio volatility while offering a steady and reliable income stream. We have also begun revisiting our life settlement allocation and various managers who specialize in this space. These investments have gained in popularity due to their zero correlation to markets but we still believe managers are operating in niche areas that can unlock value.

Summary

This is not about a recession, at least not yet. Corporate profits continue to grow robustly along while pent-up demand for travel, consumption, investment, borrowing, and the housing market remains solid. Unemployment is at 3.6% while jobs available versus those seeking work is at a multi-decade low. This is about valuation and the reassessment of risk, with the forward price/earnings ratio for US stocks falling from more than 21 times in January to less than 18 today. As markets contemplate a Fed Funds rate discounted to increase to more than 2.5% by year-end, volatility and the positive correlation between stocks and bonds is a particularly challenging combination. Bonds will not, for some time, provide a hedge to stock volatility so real estate that adjusts/raises rents in inflationary times and alternatives that have low or negative correlation are a high priority to all investors. Diversification is more important than ever and real assets and alternatives are places to move and earn cash flows.

Respectfully,

Leslie, Matt, Ryan & Ashlee