FOURTH QUARTER ECONOMIC OUTLOOK – November 23, 2022

Can the Fed Break the US Economy?

by LESLIE CALHOUN, President and CEO

Breaking the economy has been difficult The Federal Reserve has spent the last year trying to break the US economy. As Chair Powell has noted, some “pain” is likely. In the face of scorching inflation, the Fed has rapidly hiked interest rates in an attempt to slow down the wheels of the economy and get rising prices under control. But breaking the economy has proven quite difficult. Yes, the Fed has visibly slowed activity in the housing market, but by and large, the economy is still standing. In fact, rather than slow down, the economy appears ripe to get even stronger over the next several months. And if that’s right, investors and consumers better buckle up. The Fed has hinted that it may ease up on its rate hikes as inflation starts to improve, but a suddenly surging economy may force them to put the pedal back to the metal. And if that happens, there will be more pain ahead for the stock market and the US economy. The US economy is chugging along despite the proclamations that the US economy is on the brink of a recession, the real surprise is how resilient it has been. And there are even several signs that it is going to get stronger from here. The most obvious reason is that supply chain pressures are easing. Instead of looking at empty shelves or lots, people have been able to spend their money on the goods they want. Cars are a great example: total light auto sales in October hit an annualized pace of 14.9 million, the best since January. The growth is so strong that if auto sales stay at their same pace, they will add a whopping 1.5 percentage points to GDP just by themselves. Other industries are also digging themselves out of deep holes, and a long pipeline of demand will help them boost the economy well into 2023. Take aircraft manufacturers; Boeing had a stretch of bad years between the 737 Max problems and the pandemic. Today, the company is seeing new orders roll in, pushing up aircraft production with plenty of runway for continued growth.

The other good news for the economy is that the bad news isn’t getting any worse. The shock of historically fast rate hikes isn’t going to be any more severe in the coming year. Government spending dropped off in 2022, dragging on GDP, but with the money from the bipartisan infrastructure package and Inflation Reduction Act set to roll out next year, this drag will reverse. The problems that rocked the globe and dragged on international growth in 2022 — from the war and energy crisis in Europe to China’s Covid Zero policies — almost certainly can’t get more painful and have even shown signs of improving. Here in the US, the Fed has already taken a sledgehammer to several important parts of the economy — and you can’t break something twice. The construction market for homes and new commercial real estate have been hammered and they’ve cut into US GDP growth for six consecutive quarters. But after the initial shock and the whisper that the Fed may slow down their hikes, consumers expect rates to be somewhat lower over the next year. Not surprisingly, home buying intentions have picked up. Finally, financial market conditions have been easing of late. Bank of America’s Global Financial Stress Index has declined for over a month. A weaker dollar, tighter corporate credit spreads, and rally in equity prices don’t exactly scream an impending slowdown in activity. The level of the index is below where it was at the time of the June FOMC meeting. If tighter monetary policy is not keeping financial conditions tight, then policy is not really tightening!

The CHIPS Act – A game Changer for American Industry

by MATT McManus, Senior Wealth Advisor and COO

In spite of the dramatic recent election, there has been come fiscal progress this year with the passing of the The Creating Helpful Incentives to Produce Semiconductors and Science Act of 2022 (CHIPS Act). It was signed into law on August 9, 2022, and is designed to boost US competitiveness, innovation, and national security. The law aims to catalyze investments in domestic semiconductor manufacturing capacity. It also seeks to jump-start R&D and commercialization of leading-edge technologies, such as quantum computing, AI, clean energy, and nanotechnology, and create new regional high-tech hubs and a bigger, more inclusive science, technology, engineering, and math (STEM) workforce. This is a great opportunity for future investment that will propel the U.S. economy in an area of technological innovation.

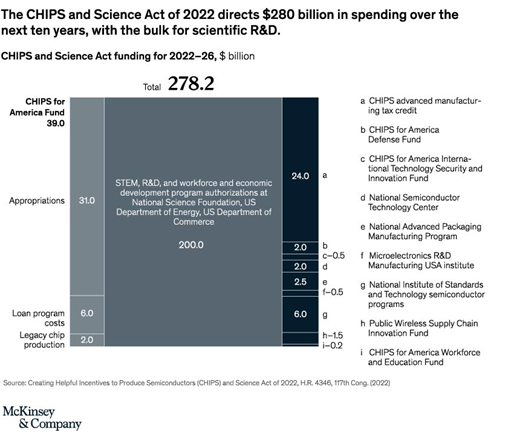

Specifically, the CHIPS Act directs $280 billion in spending over the next ten years. The majority—$200 billion—is for scientific R&D and commercialization. Some $52.7 billion is for semiconductor manufacturing, R&D, and workforce development, with another $24 billion worth of tax credits for chip production. There is also $3 billion slated for programs aimed at leading-edge technology and wireless supply chains.

Currently, the United States makes 12 percent of the world’s semiconductors, compared with 37 percent in the 1990s, according to US government statistics. Many US firms are dependent on chips made abroad, and the fragility of those supply chains has been laid bare over the past 18 months through the effects of Covid, the Russian invasion of Ukraine, and the continued lockdowns in China as a result of their zero covid policy. In the details, shortages of semiconductors dented US economic growth by nearly a quarter-trillion dollars in 2021 alone, according to the US Department of Commerce.

To expand domestic manufacturing of mature and advanced semiconductors, the Department of Commerce will oversee $50 billion in investments over five years, including $11 billion for advanced semiconductor R&D and $39 billion to accelerate and drive domestic chip production ($6 billion of which can cover direct loans and loan guarantees). Furthermore, in order to boost national security and 5G supply chains: The CHIPS Act allocates $2 billion to the US Department of Defense to fund microelectronics research, fabrication, and workforce training. An additional $500 million goes to the US Department of State to coordinate with foreign-government partners on semiconductor supply chain security. And $1.5 billion funds the USA Telecommunications Act of 2020, which aims to enhance competitiveness of software and hardware supply chains of open RAN (radio access network) 5G networks.

Given the scale of investment required, building new semiconductor fabrication plants and capacity will take more than government funding. Private investment is needed too. In order to capitalize on these future opportunities, we currently have investments like Albemarle, which addresses the underlying supply chain through raw materials like lithium mining. In addition, our Alkeon position focuses on the necessary technological innovation that is required to support the Web 3 and continued computerizing of our lives. Looking ahead we will continue to look for additional investment opportunities in this space to compliment your portfolio.

Portfolio Management

Portfolio Management

by RYAN THOMASON, CFA, Associate Portfolio Manager

Investment Strategy Spotlight – Buy-Write Strategies

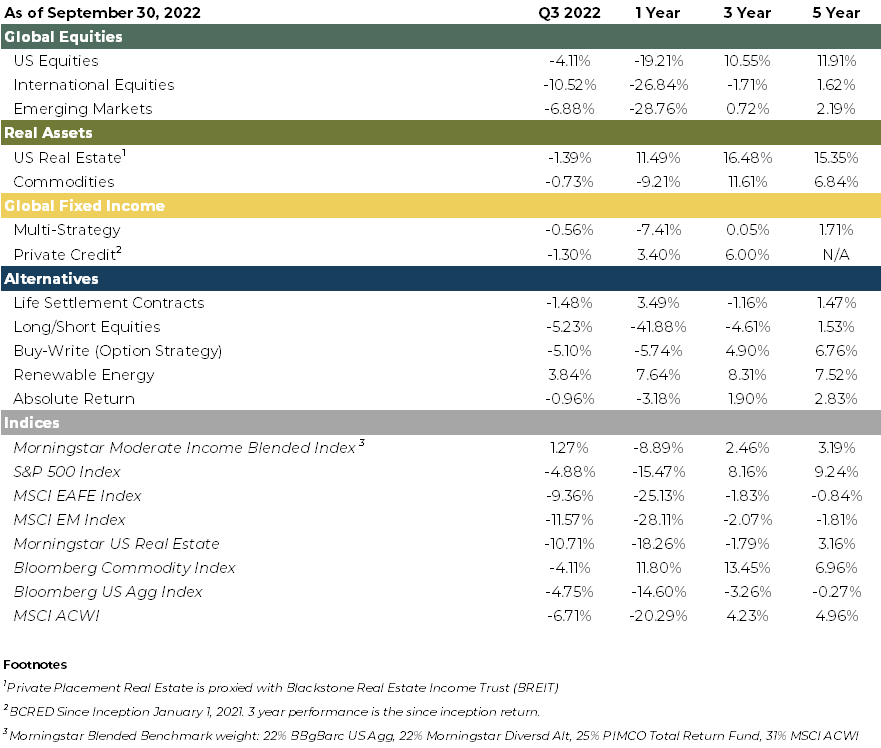

The current investment landscape has presented many challenges for investors. After a decade of very low inflation, the US Consumer Price Index (CPI) is at its highest level in four decades. The US Federal Reserve has aggressively tightened monetary policy to reduce the acceleration of inflation, which has resulted in heighted market volatility. We have witnessed the direct consequences of market tightening but are finally beginning to see their efforts pay off in the form of higher unemployment and lower than expected CPI. However, one month of promising figures does not mean a trend has formed and continued market volatility is expected. Option-based strategies such as covered call writing or buy-writes may provide investors with a degree of insulation while producing attractive levels of income.

Optivest has utilized JP Morgan’s Equity Premium Income Fund as an effective tool to dampen volatility while producing high levels of income. It is a strong strategy choice for investors who want equity exposure but in a lower risk manner. The underlying equity portfolio is defensive in nature and has been a standalone equity strategy at JP Morgan with a successful 10+ year track record. Other defensive characteristics include lower beta and lower volatility than the S&P 500 as well as a 1-2% dividend yield. The underlying portfolio also has an options overlay strategy that implements written out-of-the-money S&P 500 Index call options to generate distributable monthly income. The options are systematically written (sold) on a monthly basis and average 2% out-of-the-moneyness. As the Fed has hiked rates and market volatility ensued, we have seen option premiums (the price received for selling calls) increase as option premiums and implied volatility have a directly positive relationship. Through September 30, the strategy has a 30-day SEC Yield of 12.43% and a 12-month yield of 10.44%.

A few points that make this strategy unique is that 100% of the income is paid out monthly, the income is derived from both dividends and call option premiums, the income serves as a natural hedge against the underlying defensive portfolio, and the laddering of options every month allows for potential increases in distributable income as volatility ticks upward.

There are two key considerations that investors must be aware of. First, the strategy may not capture all the market’s upside because writing call options puts a ceiling on how much upside you are able to participate in. It is important to understand how this strategy performs in a falling, sideways/gently rising, and rising market. In a falling market, the conservative equity portfolio and income potentially buffer a portion of the downside. In a sideways or gently rising market, we realize capital appreciation and income. In a rising market, we forgo some upside for income received. The second consideration is that monthly distributions can vary each month. As mentioned before, option premiums can vary dependent upon prevailing volatility. When volatility increases, both income and the potential for capital appreciation also increase and vice versa. If volatility goes to extreme highs, we may experience above-average-range annualized income. If volatility goes to extreme lows, we may experience below-average-range annualized income.

Deploying a buy-write strategy into portfolios has played an integral role in producing a nice balance of income and a portion of upside with reduced equity risk potential. This is evident by the JP Morgan Equity Premium Income fund delivering 5.2 times the income of the S&P 500 with a portion of the upside and 71% of the volatility. We will continue to utilize the strategy especially for clients who have the investment objective of income generation with modest risk.

Summary

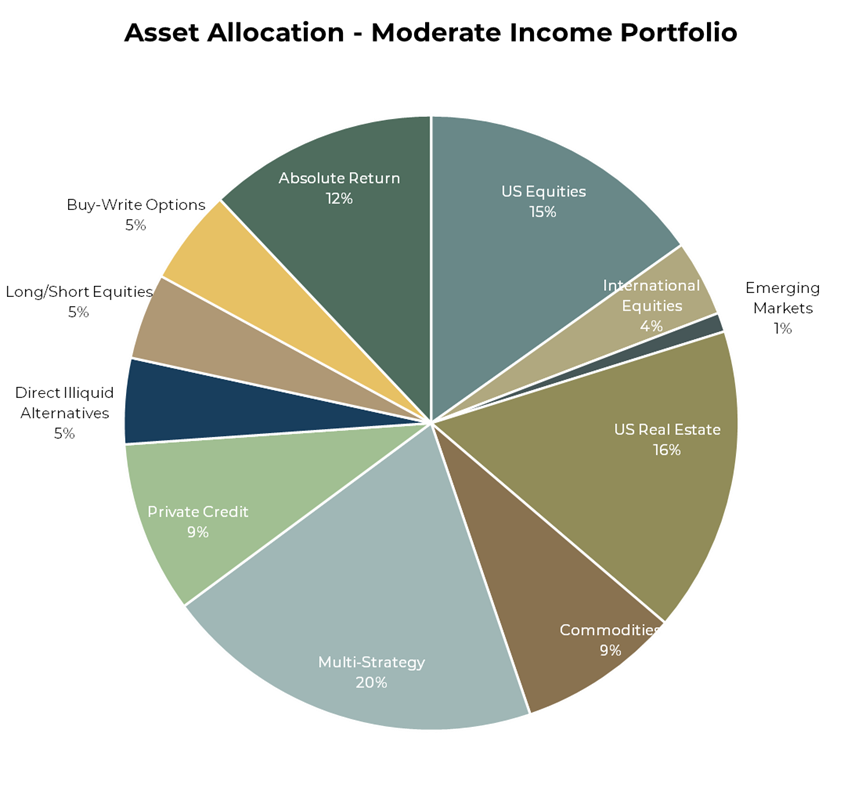

While some markers of inflation are starting to cool, the labor market is still very tight, and there is a large amount of cash liquidity on household balance sheets as seen in record high levels of bank deposits. It seems likely that elevated inflation and interest rates will persist for a period of time, at least through 2023. Our forecast has been that financial market returns over the next five years to be modestly below long-term historical averages, so we have focused on income generation over growth investing.

Respectfully,

Leslie, Matt, Ryan, Ashlee & Katherine