SECOND QUARTER ECONOMIC OUTLOOK – April 18, 2023

At long last, it’s good to be a lender, again

by LESLIE CALHOUN, President and CEO

Beneath a decent rally to start the year, risks to the economy remain. Even though headlines have focused lately on the Federal Reserve’s dual mandates of full employment and controlling inflation, the Fed actually has three mandates and includes maintaining financial stability. Getting all three to line up in the direction they intend often results in at least temporary impairment of one to benefit the others. This is why the phrase, “The Fed will break something” is part of our vernacular.

Unemployment is stubbornly low but job openings at last seem to be declining as companies hold back on hiring and even in some cases, are reducing staff, which eventually leads to reduction in wage inflation. The recent bank stress will likely result in credit getting squeezed, which will slow business production in addition to the Fed’s attempts at slowing – double whammy. Then throw in banking instability and an upcoming debt ceiling negotiation and we have a recipe for more volatility and uncertainty in markets.

The PCE and CPI inflation tracking indices are experiencing a higher-than-normal divergence. High level comparison – PCE tracks consumer and third-party expenditures (both urban and rural) while CPI tracks only urban consumer expenditures. The Fed tends to focus more on PCE than CPI which is a larger, slower, and broader measure of inflation. The most simplified explanation is that including third-party expenditures in PCE underweights the impact of shelter and fuel costs which individual consumers feel acutely. Additionally, the pandemic drove up health-related third-party expenditures (think big insurance companies) which has placed further pressure on the relative weight of shelter and fuel prices in the PCE. The interest rate sensitivity of housing coupled with its prominence in consumer expenditures, means that misjudging it relative to price movements can lead to policy errors. It’s also possible that that the reverse trajectory may result in a similar divergence, but we cannot forget, there is latency in reporting, particularly shelter costs. With all these factors combining, it’s easy to see that soft landings are hard to achieve, and recessions are usually the result of rising rate policy. The fact is that there is seldom a period of perfection in economies where investing is simple and straight forward.

While the Fed tinkers with monetary policy, the US is quickly headed to reaching its debt ceiling. The divided Congress could come to a point of compromising but this doesn’t seem to be the environment in which this is likely their first move. For certain, a slow or no deal/compromise on the debt ceiling will create more market volatility and will make the already weakening US Dollar weaken further.

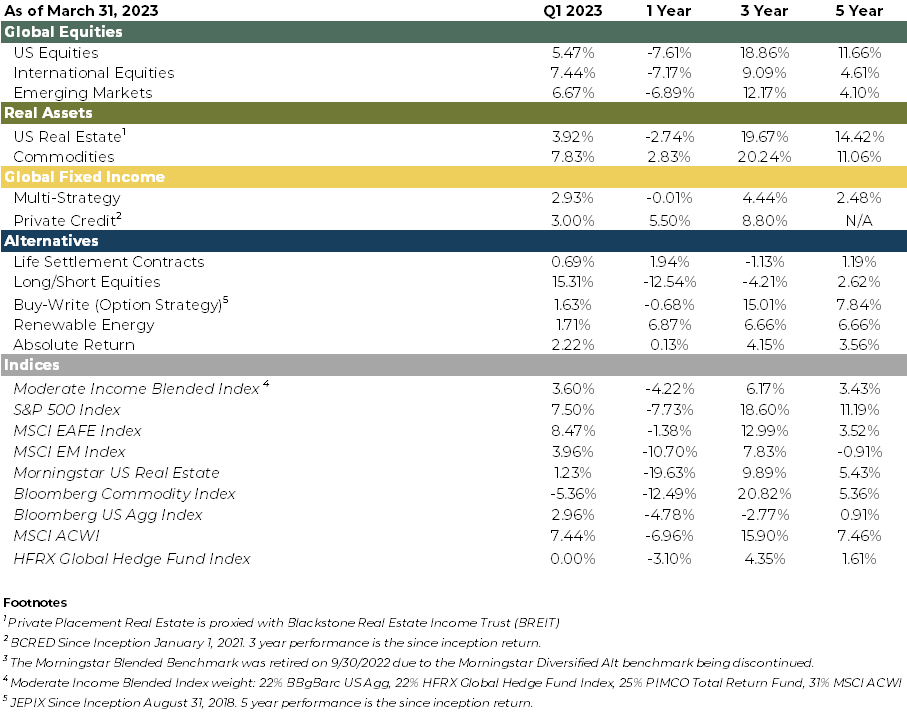

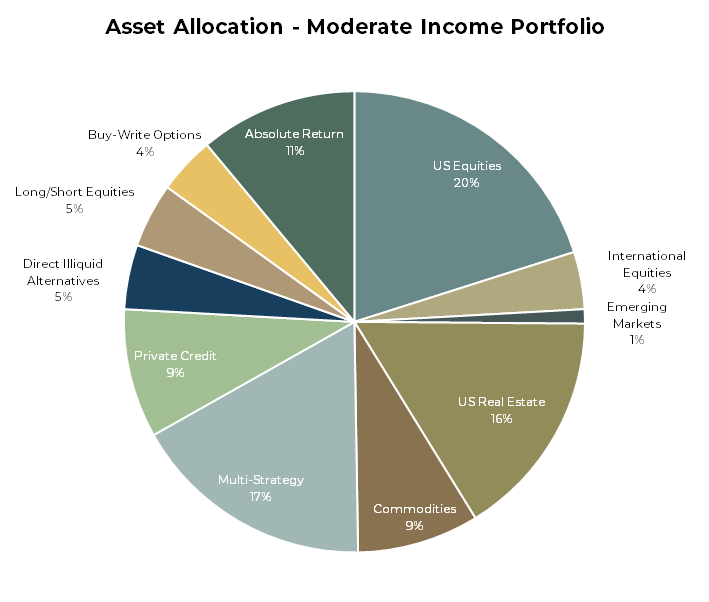

Until last year, for decades bonds have been a drag on returns that came in handy if markets fell. Now after years of TINA (There Is No Alternative) to stocks because fixed income yields were tied to historically long and low interest rates and could not provide close to enough income to live off of, after the past 12 months of rate hikes, we finally have alternatives. Through the fastest rate hike regime since the 1980’s, we moved our strategic investing strategy to focus more on generating returns through income generation than solely through growth investing. We still have conviction on quality assets with strong and healthy balance sheets and keep exposure to well capitalized healthy businesses. Over the last 16 – 18 months we have added allocations to dividend paying stocks, high-demand commercial real estate sector via preferred equity, floating-rate fixed income, and finally to short-term CDs, money markets and longer duration fixed income as we see a leveling off coming in rate hikes.

In Europe, moderate winter weather helped stave off a crisis set off by elevated fuel and heating prices. Inflation still runs high here (and in Great Britain). Their Central Banks are following the Fed with rate increases, just at a slower pace. It can be argued they benefit by watching what the Fed breaks in the US to potentially avoid the same results. We believe all Central Banks are probably pretty far along in their tightening campaigns. Emerging markets will benefit from a declining US Dollar and we are exploring new ways to invest in emerging markets where we think there is a more optimal blend of consistent growth combined with stable political policy. China presents far more risk than opportunity at this juncture with a destabilized housing market, outright disregard of international policy and their economic restart amidst a falling population.

In light of all this, our basic premise is that it will be easier to navigate inflation’s negative impact on corporate earnings and consumer balance sheets in 2023 than it was last year with inflation continually surprising central banks and investors in 2022. The massive increase in short-term interest rates has created attractive total return opportunities across several parts of the global capital markets without having to venture into high leverage, volatility, or risk. This is the best time to be a lender in well over a decade and we continue to lean into collateral-backed cash flows such as private credit and real estate. Liquid fixed income strategies are at long last attractive again. In equities, we like quality companies with strong balance sheets. We stay committed to keeping exposure to technology with advances in AI and efficiency creation as these will be even more essential to companies in the next expansionary phase than ever before. With the likelihood of the reverse in the US Dollar, down just over 1.6% ytd, International and EM assets are attractive.

Estate Plan Spring Cleaning

by MATT McMANUS, Wealth Advisor and COO

Spring cleaning isn’t just for your home, it’s also a great time to make sure your Estate Plan is up to date. Often once your initial Estate Plan gets completed, it tends to gather dust and over time may become stale and not reflect your current assets, charitable intentions, and even your current family members! It’s also very important to make sure that in the event of a sudden passing, your spouse and heirs can access your accounts, utility bills, and if you’re a business owner, to have a plan to ensure continuity.

Most Estate Planning professionals would recommend you update and/or review your Estate Plan every 3-5 years. Listed below are some Estate Planning considerations you may want to look into to ensure your Estate Plan fits all your current needs.

- Inventory Your Assets – It’s important you have a thorough understanding of what property you own and how you plan to distribute it. Take stock of all your assets including real property, personal property, financial accounts, etc. It’s also important you take into account any debts you may have and who is obligated to pay for them if you become incapacitated or pass away. You should also review your real estate to ensure it is titled in trust name to avoid any complications.

- Identify Your Beneficiaries or Heirs – Ensure you know who your beneficiaries or heirs are and that they are given your property according to your wishes. For instance, in California, any community property is automatically given to the surviving spouse. If you want to distribute certain property to certain people, you’ll need to ensure your Estate Planning documents reflect that.

- Ensure You Have the Right Executor or Trustee – One of the most important parts of your Estate Plan is to appoint an executor or successor trustee for your estate. As time passes, situations change and individuals we may have selected as a trustee or executor may no longer be the best fit. For example, if your personal representative of the estate has aged to the point of incapacity, moved away, or passed on, then you’ll have to appoint a new one.

- New Additions or Omissions – It’s important you update all your relevant Estate Planning documents if you’d like to include new family members. This is especially common for those who have just had a new child or grandchild. Additionally, there may be instances where you would like to omit a family member from your estate. We frequently see this after a divorce or sudden death.

- Moved to Another State – Every state has its own Estate Planning laws. That is why it’s so important you update your Estate Plan as soon as possible if you’ve moved to a new state. You may have to modify or rewrite certain Estate Planning documents because they don’t fit the new state requirements.

Estate Plans are of vital importance for business owners as well. Whether you want your family to continue building your legacy, your business partners to buy your shares, or your heirs to sell the business for a fair price. Having a well-thought-out Estate Plan in place helps your beneficiaries follow a clear plan of action if you pass away. The Estate Planning process for business owners might also require a number of other elements to make sure your business lands in capable hands.

- Buy-sell agreement – Buy-sell agreements are important for small businesses with multiple owners. These agreements typically allow existing business partners to purchase your shares of the business upon certain conditions, such as your death. They dictate who can and cannot purchase the shares and provide a sale price. Establishing a buy-sell agreement ensures that your heirs don’t inherit a business they don’t want and that the shares are purchased for a fair price.

- Life Insurance – Life insurance policies are important to small business owners for a few reasons. Your business might not offer enough cash flow to provide for your family or heirs after your death to ensure they have enough liquidity to manage your affairs. Life insurance policies might also be useful for helping remaining business partners buy out your shares of the business if you name them as beneficiaries.

- Succession plan – Many business owners dream of passing their business down to their family members. If this is your goal, creating a succession plan can ensure this process goes smoothly and sets your beneficiaries up for success. In your succession plan, you should designate an heir to inherit the business and provide details on when and how they should gain control of it. You should also create a strategy to pass on important information and delegate authority and responsibility to successors. If you’d prefer the business to be sold upon your death, your succession plan should state so and explain how.

- Living Trust – Small business owners might also want to consider establishing a trust that holds their shares of the business. Putting your business shares into a living trust instead of a will keeps your business out of court and protects it from probate. Through the trust, your business assets can be transferred to a new owner that you designate privately without the hassle or fees of probate court criteria required from the State.

In addition, an area of Estate Planning that is often overlooked is also your digital life. 30 years ago, no one would have dreamed that so many of the daily services we depend on could all be found and accessed on the internet. Fast forward to today and all of our utility bills, bank accounts, and investments can be accessed, paid for, and modified by simply visiting a website. With the convenience though, also comes the risk of losing access if you forget your passwords or can’t access your email. Furthermore, in the event of someone suddenly passing away, the last thing your survivors want to worry about is keeping the lights on and the phone bill paid. Therefore, you may want to consider the use of a password manager. There are many choices such as LastPass, Nordpass, and 1Password just to name a few. The setup has gotten much easier as the technology has improved and with one master password you can access all of your passwords. By centralizing all of your accounts it becomes much easier to manage and at the same time share access with your heirs.

All things change in time, and along with legislative changes there are always new variables to consider. Your Estate Plan is not a static document but in fact a living plan that needs refreshing from time to time. As you consider any updates, it is also important to communicate any changes with your trusted advisors (Wealth Advisor, CPA, Estate Planner), etc… to ensure your changes are applied to all of your assets moving forward.

Portfolio Management

Portfolio Management

by RYAN THOMASON, CFA, Associate Portfolio Manager

The Long-Awaited Return of Fixed Income

Fixed income investors are happy that 2022 is behind us after one of the worst years on record for bonds. This was primarily driven by the Fed’s most aggressive rate hiking campaign since the 1980 Volcker-era tightening. Although recent events have brought additional uncertainty to capital markets, we believe investment grade fixed income is in its best position in years.

The Federal Reserve is closer to the end of their rate hiking cycle than the beginning, which means the terminal rate is not as much in question as it once was. With the terminal rate in sight, the expectation is that we should see a downward shift in the yield curve, which directly translates into bond price appreciation. This would occur because the Fed will cut rates due to either quelling inflation or causing a recession. The fixed income market is showing asymmetric risks and we intend to capitalize on that (i.e., there is a higher likelihood that the yield curve shifts downward than upward and thus creates a higher likelihood that bond prices will go up versus down). As we approach a potential recession, we are tilting more into bonds with higher credit quality and longer duration than before.

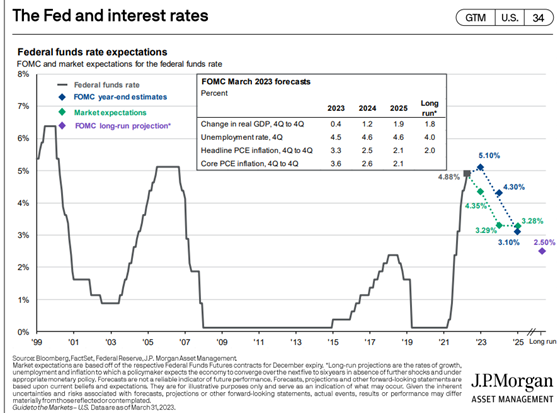

As seen below, there is a disconnect between where the Fed thinks rates will be at year-end and where the market believes they will be. This is just another reason why we expect volatility in the fixed income markets to continue, which is currently twice as high compared to its long-term levels. In addition to the Fed-market disconnect, we also have employment, geopolitical issues, ongoing angst surrounding the banking industry, and inflation numbers in the coming months that are likely to create bouts of volatility. It is during this volatility that opportunities can be realized.

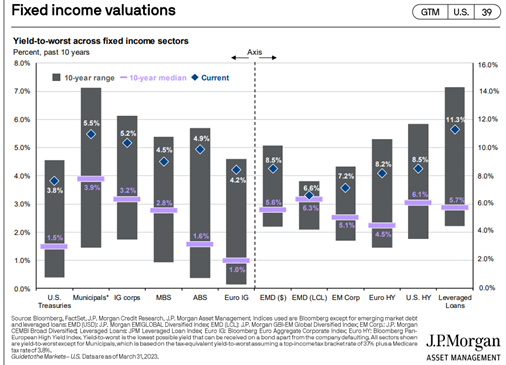

Fixed Income valuations are also currently very attractive. The slide below shows yields of different fixed-income sectors relative to their 10-year ranges and medians. Current yields are at some of their highest levels in the U.S. in the past decade, illustrating that the fixed-income market now offers meaningful income, yield protection, and relatively attractive valuations.

After seeing the Bloomberg U.S. Aggregate Index fall by 13% in 2022 – its worst year on record – it is understandable that some investors may feel queasy and hesitant at the prospect of jumping back into fixed-income markets. However, it is important to remember that the yield of a bond benchmark provides a reasonable estimate of its forward return. With the current yield offered by the bond markets potentially the high-water mark for this rate hiking cycle, we feel it would be important to take advantage of this opportunity before the window begins to close.

Client services & IT

Client services & IT

by ASHLEE ENZENSPERGER, Director of Client Services and IT

Multi-Factor Authentication and You – Important Update from Optivest

At Optivest, keeping your personal information secure and safe is of utmost importance to us. As the use of AI-generated voice replication becomes more prevalent, we are adding additional security measures to protect your information.

Going forward, for any cash or security movement requests, in or out of your accounts, we will be adding Multi-Factor Authentication in the form of a code sent to your cell phone via text message. This will be in addition to the existing Verbal Authentication and Confirmation we already do to ensure any requests are authentic. If you have recently changed your mobile number, please reach out so that we can get it updated.

If you have any questions about this or other technology-related concerns, please do not hesitate to reach out. We are here to help and assist you.

Summary

There seems to be no end to what is being predicted as to what can go right and what can go wrong. We find trying to predict what the Fed and politicians will do next to be futile. Rather we focus on prudent asset allocation, solid financial fundamentals, and probable outcomes in light of time frames of many years.

And in case you missed it, there was recent good news in the self-storage real estate space. While Life Storage (LSI) which was the third largest operator behind Public Storage (PSA) and Extra Space (EXR) declined a sale of its company and assets to PSA in December, they have agreed to be acquired by EXR at a 30% premium to where their stock was trading at the time of the offer in February. The merged company will supplant PSA as the largest self-storage operator in the US. This premium price offered for LSI by a strategic buyer indicates we are not the only ones seeing the self-storage REIT space overly discounted. We expect the merger to close in the third quarter of this year.

Respectfully,

Leslie, Matt, Ryan, Ashlee & Katherine