Market Changes – Update

March 11, 2020

The impact of the Coronavirus otherwise known as COVID-19 continues to rattle market and world confidence. As new developments in the detection of the virus have continued to lead headlines, the result has been the development of an incredibly emotionally charged environment. Beginning last year and into earlier this year, we took pre-emptive steps to de-risk the portfolio including a shift to more large cap domestic exposure over international equities, increased exposure to gold and self-storage, and the elimination of our floating rate bond positions. These moves have positioned us well for the current volatility.

As a reminder, a diversified portfolio is meant to serve you in good markets and bad. The decrease in equity value is mitigated by our counter-balancing non-correlated Longevity contract hedge funds, low correlation alternatives, and high credit quality/short duration bond exposure. And of course, our niche real estate investments are diversified between self-storage, multi-family, limited service hotels, essential high-credit tenant office and retail, and some legacy retail plazas. Again, the diversity of the investments serves as a counter-balance; there may be supply-chain or travel interruptions but debt service is either lower if floating or refinanced in the current low rate environment.

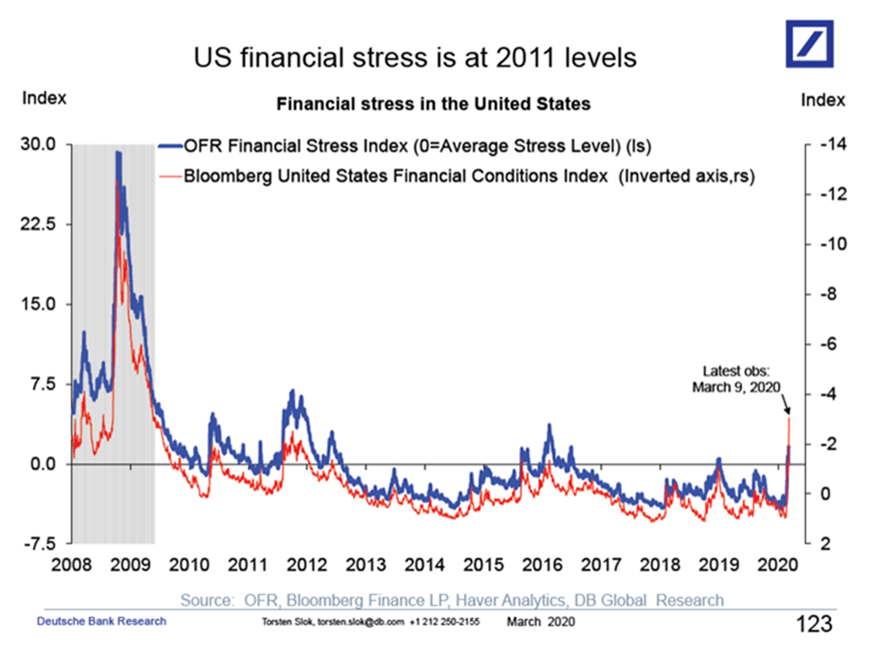

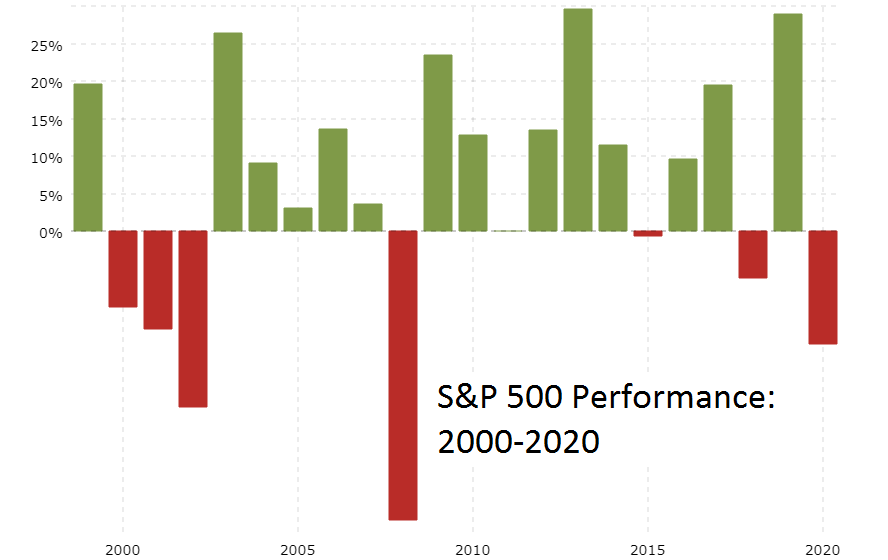

The markets appear panicked but we are certain algorithmic and program trading make markets much more volatile and can exaggerate the feeling of panic. Analysis says US financial stress is at 2011 levels and 2011 was a flat year for the S&P 500 as evidenced in the next graph.

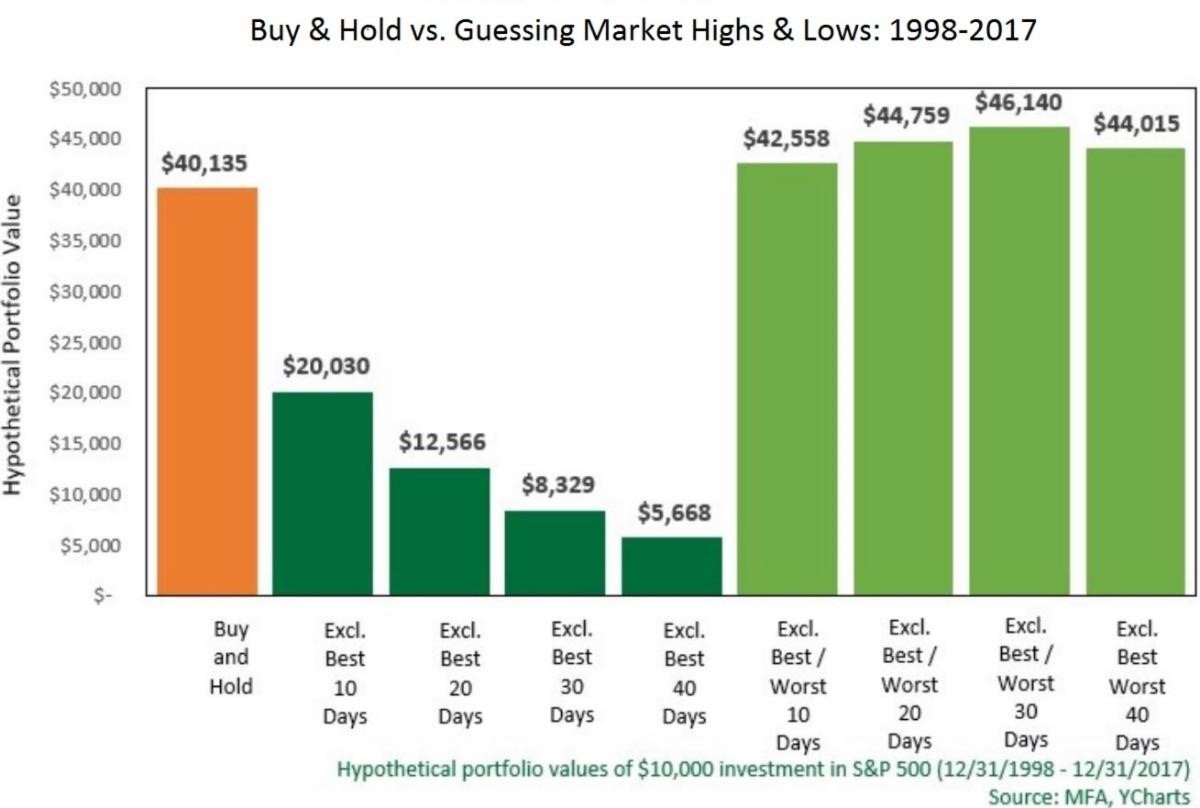

Our philosophy remains unwavering in the need to have a diversified investment strategy. A diversified portfolio is meant to serve you in both good markets and bad. Our diversification edict is to continue to maintain positions in equities, bonds, real assets, and alternatives. As reflected in the graph below, this is not the time to pick the high of the market or the low.

This is the time to hold fast to our durable and diverse portfolio holdings and allow the COVID-19 virus and resulting issues to be resolved. Although we do not yet have an end in sight to the control of the virus, we do know that in time this too shall pass. We remain vigilant and focused on the ongoing changes in the world and will take action and communicate if anything changes our current approach. Please feel free to reach out with questions, we are here to serve your needs.