FIRST QUARTER ECONOMIC OUTLOOK – January 31, 2022

Delayed but not canceled

by LESLIE CALHOUN, President and CEO

Happy new year? A new year and another COVID-19 variant. I hope I never have to write that phrase again. COVID in its more virulent but less deadly form, Omicron, remains in the headlines as we begin 2022 and has the potential to slow but not derail our strong recovery. Yet Omicron may also have a silver lining as its highly infectious nature may turn COVID into an endemic disease similar to the flu as populations build up immunity and annual booster shots keep down the human toll.

We expect macroeconomic policy will come more into focus as the support created through various stimulus packages over years 2020/2021 continues to diminish or are actively removed into 2022-2024. At uneven rates determined by central bank policy, population vaccination rates, and supply chain resolution, global economic recovery will likely continue into 2022. Last year brought massive earnings growth of 33% despite supply-chain constraints and rising inflation. 2022 will likely bring many of the same headwinds along with a few new ones – persistent inflation (particularly stickier wage, energy and shelter inflation), the US Fed becoming hawkish, budget reconciliation, and mid-term elections. We believe the stock market had a knee-jerk reaction in early 2022 to the Fed agenda to both shrink their balance sheet and raise rates in 2022. While it is likely to create more volatility, we believe the Fed wants to control inflation but not at the expense of creating market maelstrom.

Historically the market has positive returns early on during periods when rate hikes occur and begins to diverge 9 – 11 months after hikes begin or when rates pass 3.5%. But in the present high inflation environment, real rates would still be negative at 3.5% so we must watch for the Fed’s end game. In prior cycles, the end game was a policy rate above the rate of inflation. We think the Fed’s end game this cycle is going to be a policy rate that more or less matches inflation and this will be a long game. In other words, we see inflation gradually declining and rates rising, but real rates will remain low or even zero and this should take a fair amount of time. Low or zero real rates create an environment still very favorable for risk-taking.

It’s looking like we are beginning to see a loosening of our supply chain as the ultra-high demand for goods over services is stalling out as stimulus continues to dissipate and people are more settled into a modified lifestyle of hybrid work and just weary of social distancing. As supply-chains heal and production capacity normalizes, headline inflation should start to fall. Higher borrowing and production costs can still be passed on to consumers earning higher wages at close to full employment level, thus we see still positive but likely lower earnings growth this year after the explosive growth last year still coming out of the pandemic.

China’s desire to achieve high growth in the face of recurring COVID contagion means to reach growth targets they will have to loosen policy. We see a significant shift in China’s overall policy stance toward greater state intervention and social objectives, even at the occasional expense of growth. We expect stricter regulation in China to persist but think it’s unlikely to intensify in the politically significant year of 2022 given slowing growth. We expect Beijing to gradually loosen monetary and fiscal policies – that remain very hawkish relative to developed markets – to shore up growth. Policymakers have taken advantage of strong post-COVID growth to push through reforms. Yet risks to growth from new COVID-19 variants would further warrant more easing.

In Europe, The ECB lags our Central Bank response. Whereas the Fed is content to overshoot inflation targets, the ECB wants to get inflation to settle at 2% rather than falling well short as it has for years. The ECB’s medium-term inflation projections are likely to settle below its 2% target. That suggests ongoing policy stimulus. We don’t see the ECB lifting rates for a few more years and think it will likely increase its regular asset purchases as the special pandemic program is set to end next year.

Is it time to update your Financial Plan?

by MATT MCMANUS, M.A., CFP®, Senior Wealth Advisor and COO

At Optivest we are constantly evaluating the quantitative and qualitative changes in the world and in our economy, to better understand what the opportunities and risks are in the future. Although we can’t know and control all the variables, we can use our knowledge of today to better predict what tomorrow may look like. As life changes from year to year, some changes are mild and some are significant. If you’re still using the Financial Plan you created two or three years ago, it may not align with your current goals or needs. It may be time for an update!

Financial pictures change rapidly, so it’s important to take an in-depth look each year to better reflect the relevance of your plan in today’s context. You may find that your plan needs just a quick revision or it may need a complete overhaul. You won’t know until you sit down and do the math though, quite literally.

Depending on what stage you are in life, you are likely in an accumulation phase (pre-retirement) or a distribution phase (post-retirement). Either way, cash flow, and investment performance are vital to reaching your goals. In an accumulation phase, your focus should be maximizing savings and investment in multiple types of assets and taxation account types. In a distribution phase, your focus should be on maintaining a reasonable withdrawal rate and ensuring your investments provide sufficient income, liquidity, and are reflective of your risk tolerance.

In each case, a Financial Plan update can help you evaluate your short-term and long-term goals and decide where you are in meeting them. If you find that you’ve knocked a few out, it’s time to revamp and add more. If you’re behind on meeting your goals, you may want to revise them to meet your current financial circumstances. Financial planning isn’t just spreadsheets and balance sheets. It’s the consideration of dreams and meaningful experiences for family that last even beyond a certain lifetime.

As an example, another concept that requires ongoing analysis is the use of leverage, otherwise known as debt. Leverage can be an excellent tool to allow you to maximize your financial resources, whether that’s in purchasing income-producing real estate or lowering the withdrawal rate from your investments during periods of market turmoil. Although we are now in a rising rate environment, capital can still be accessed at rates that are favorable depending on the use of the funds. Through the use of margin, fixed-rate loans, or even the Schwab Pledged Asset Lines of Credit, a comprehensive Financial Plan can incorporate these concepts and detail the most efficient use of leverage and capital.

As we reflect on a more volatile investment environment, the ability to focus beyond the day-to-day market gyrations and instead on the longer-term goals can help bring clarity and confidence. Our Financial Planning models incorporate the diversified and durable portfolios that Optivest exclusively offers that can provide enhanced stability in turbulent markets. If you’re interested in updating your Financial Plan, please reach out to us today!

Portfolio Management

Portfolio Management

by RYAN THOMASON, Associate Portfolio Manager

Year in Review: Asian Emerging Markets

In the second half of 2020, we made the case for why Emerging Markets, specifically in Asia, deserved a second look. The bull case was built on the foundation that new government policies, economic reforms, and technological innovation would spur growth and propel the region into a period of above-average growth that would reward investors. After we shifted portfolios accordingly, we saw strong performance for the remainder of 2020. However, near the beginning of 2021, performance became volatile, and it began to look like our bull-case scenario was being threatened.

Several events negatively impacted the growth story in Asian emerging markets in 2021. This included China’s zero-COVID policy which locked-down cities to contain the spread of COVID-19. When this occurred in port cities, the ports were shut down, creating a supply bottleneck that only exacerbated global supply shortages. There was a reduction of fiscal and monetary stimulus that weighed heavily on both credit growth and infrastructure investment. Regulators tightened policies affecting the property sector, creating financial stress among property developers and causing a sharp drop in real estate activity, which normally accounts for approximately 25% of GDP. Lastly, we witnessed Chinese regulators ramp up regulatory oversight on some of the region’s largest companies. This subsequently created negative sentiment among overseas investors and triggered volatility and stock selloffs.

We believe 2022 will result in stronger economic performance and improved sentiment. The most notable tailwind we see is a clear easing cycle that is already developing in Beijing. This will be a modest and gradual stimulus, but it should be large enough to reverse the macro slowdown that resulted from last year’s overly tight policies. The central bank governor said he would promote a modest expansion of credit growth. The Ministry of Finance said China will implement a “proactive fiscal policy” and tax cuts, as well as increase transfer payments from the central government to local governments. We are already seeing the central bank make modest cuts to bank-required reserve ratios and reduce the one-year loan prime rate for the first time in 20 months. We should tread lightly thinking the central bank will do everything they say they will do, but we are seeing them take initial, concrete easing steps in the right direction.

The largest risk to our thesis in 2022 is not increased regulatory oversight but geopolitical tensions with the US. We are witnessing heightened cold-war rhetoric coupled with sanctions that are designed to weaken the competitiveness of Chinese companies. President Biden has yet to clearly articulate his administration’s strategy on mending relations with China and a policy surprise could cloud the investment landscape abroad.

In a world where different countries are adopting easing policies whereas others are adopting restrictive policies, more volatility can be expected. GDP growth rates in China have decreased relative to the prior year, yet it is still comparably higher than other regions we invest in such as the US and Europe. In sum, investing in Asian emerging markets are not without risks, but we believe the tailwinds will prevail.

Summary

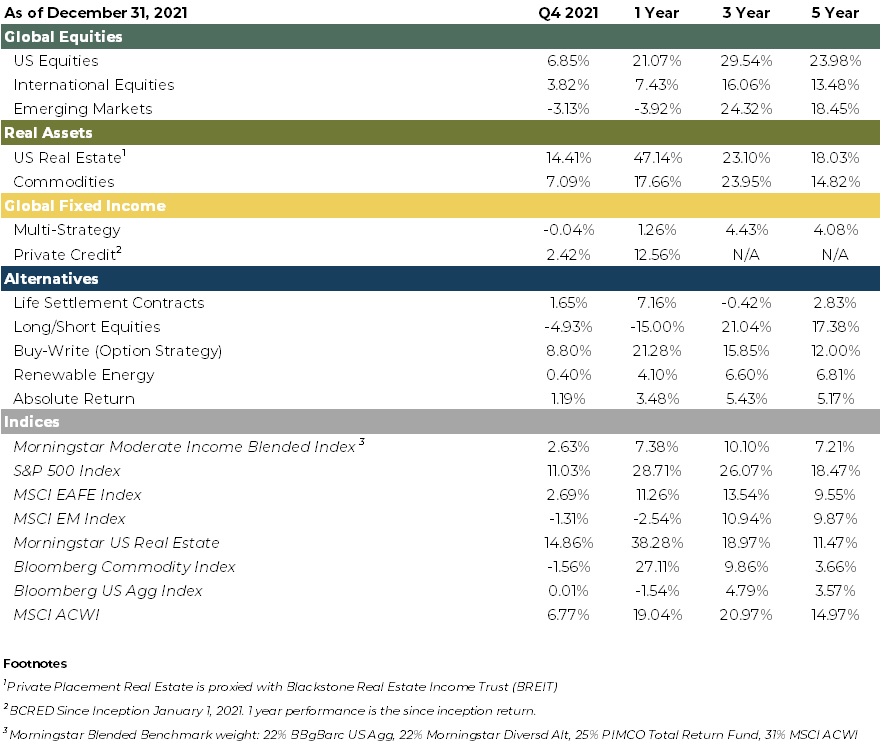

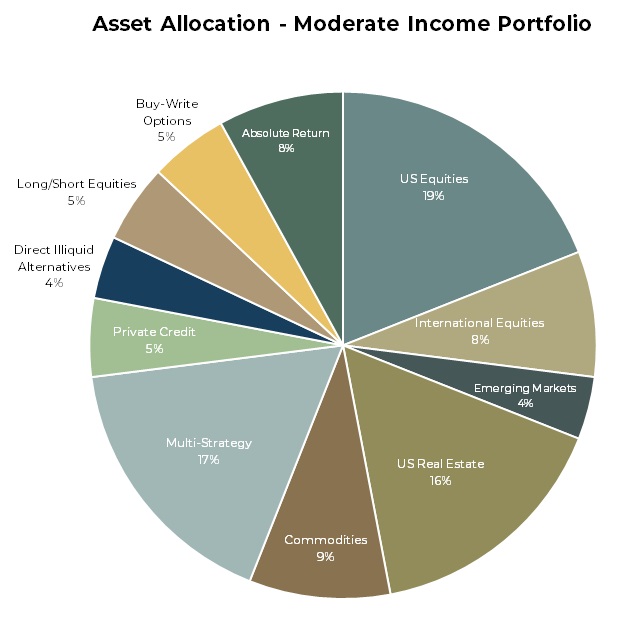

In 2021, we made tactical moves in our investment portfolios to underweight US bond exposure, be overweight in real estate and build cash reserves for deployment in 2022 when we see volatility increasing due to headwinds. The US Barclays Agg (a moderate-duration bond index) is -4.31% from its high last year and only faces more losses in face of rising rates. The multi-decade bond rally is indeed over and in reality, it was only briefly interrupted by the pandemic. Our real estate exposure continues to out-perform other asset classes as the interest on leverage is still historically low (and often was refinanced to low fixed-rate over past years) and the asset values appreciate with inflation bringing total returns to the highest levels seen in years. Pensions and institutions continue to invest heavily into real estate in the new bond bear market. In this environment, keen asset selection can make value add purchase and development deals very profitable.

Markets seem primed to equate higher rates as being negative for equities. We’ve seen this before and don’t agree. What really matters is that the Fed is signaling slow and cautious rate hikes, supportive of minimal market impact. This historically muted response to inflation should keep real rates low, in our view, supporting equities and real estate. Stay invested and stay diversified for positive returns occur more frequently over longer periods than negative returns and policy is supportive of high-quality investing. Fundamentals matter.

Respectfully,

Leslie, Matt, Ryan & Ashlee