Experience

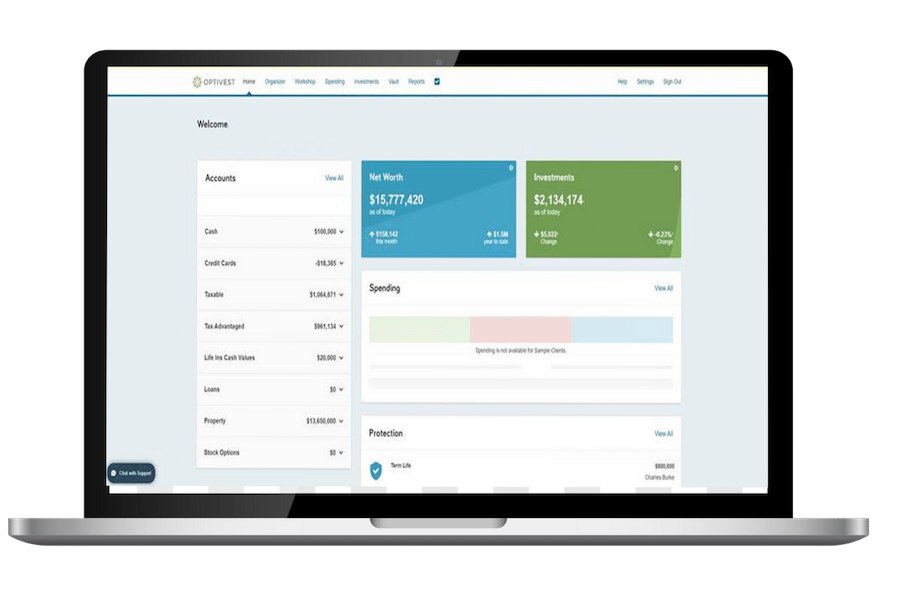

At Optivest, we offer wealth management services, legacy financial planning, and real estate and alternative investment opportunities. Contact us to learn more about our services and how we can help you secure the financial future you deserve. Our approach is collaborative and thorough to ensure that together we’re creating and delivering strategies that allow you to make decisions today and in the future that will meet your goals.

Optivest employs an “open architecture” investment platform enabling us to invest into all investment options and specialty managers available. We are well versed in the complicated features of Wealth Management for high-net-worth families like yours and look forward to providing you with high level investment consulting, asset protection, and relationship management you deserve to feel confident about your future.

Optivest is a deep believer in the role of active management, and we construct and update our models based on that approach. The asset allocation recommendation takes into consideration your age, present assets, priorities, goals, and risk tolerances. Our portfolio strategies utiltize an optimum asset allocation, given your objectives and the present market environment. The specific security managers are what our research sources indicate are best-in-class selections based on risk-adjusted performance and low fees.

Optivest’s team of seasoned professionals strive for superior returns and low volatility through a strategic blend of equity, fixed income, alternatives and real estate in order to maximize diversification and produce durable portfolios that can perform in all markets.

OptiPlan Questionnaire

We invest directly with real estate managers who have a longstanding record of success. Our Real Estate investment opportunities include multi-family, hospitality, self-storage, and specialized properties. These opportunities can provide tax-sheltered income to further enhance the value of your portfolio.

When appropriate, we can coordinate DST transactions for our clients private real estate portfolios. DSTs provide 1031 exchange eligibility during initial investment and upon exit, which offers a unique advantage by deferring the recognition of capital gains from another investment real estate property.

We deploy alternative investment strategies through a variety of vehicles to broaden portfolio returns and help dampen volatility.

view your account information and process account updates.