Market Changes – A Period in Time

March 18, 2020

Today we again witnessed a very volatile market as we anxiously await to see what type of fiscal stimulus we can expect, and as the impact from the Covid-19 virus continues to expand.

Attached below we have included a few key charts that we selected from JP Morgan that highlights the importance of diversification, discipline, and the wisdom of investing.

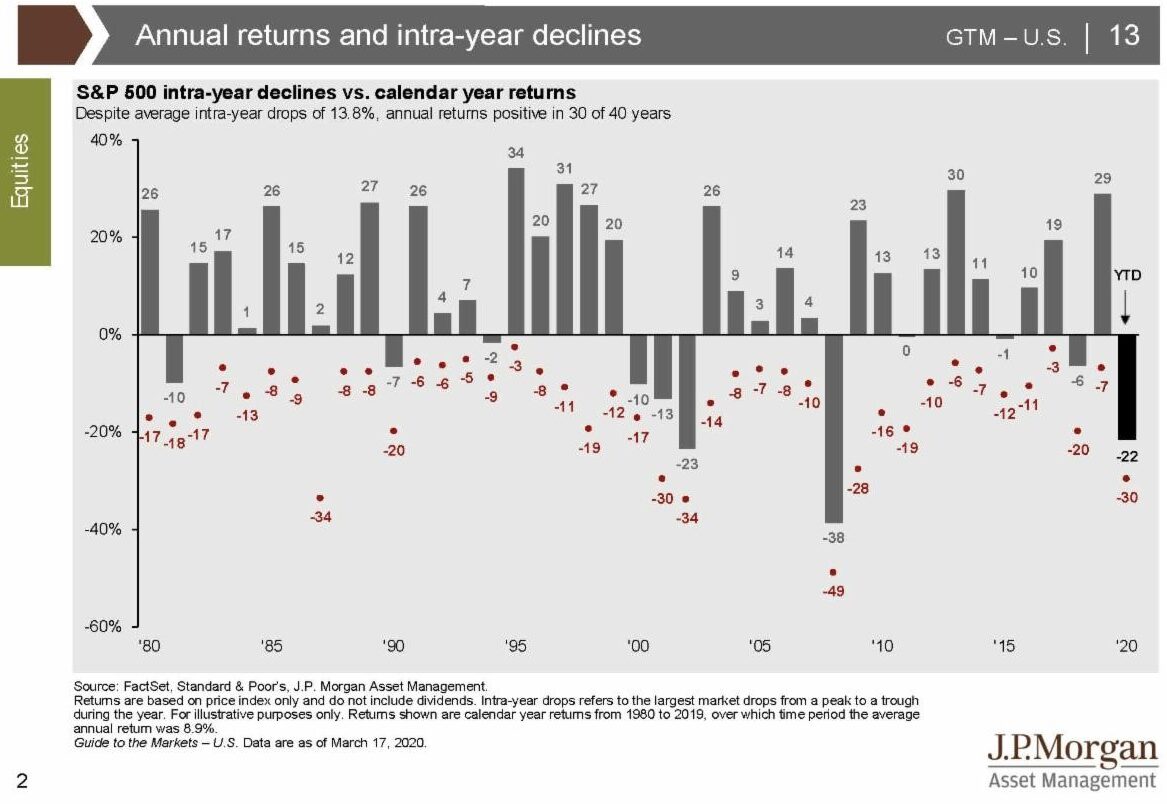

The first slide, Annual returns and intra-year declines, shows that despite average intra-year drops of 13.8%,the stock market has positive annual calendar returns 3 out of every 4 times.  The second slide, Diversification and the average investor, shows the impact over the long run of utilizing a diversified portfolio. Please keep in mind that the diversified portfolio shown here is limited to just equities and bonds. Even in that case, holding just 60% in equities and 40% in bonds recovered to previous October 2007 values after the Great Recession in just three years. While at Optivest our clients diversify more broadly than just stocks and bonds. We also invest in REITs, real estate, gold, longevity contracts, and other alternatives.

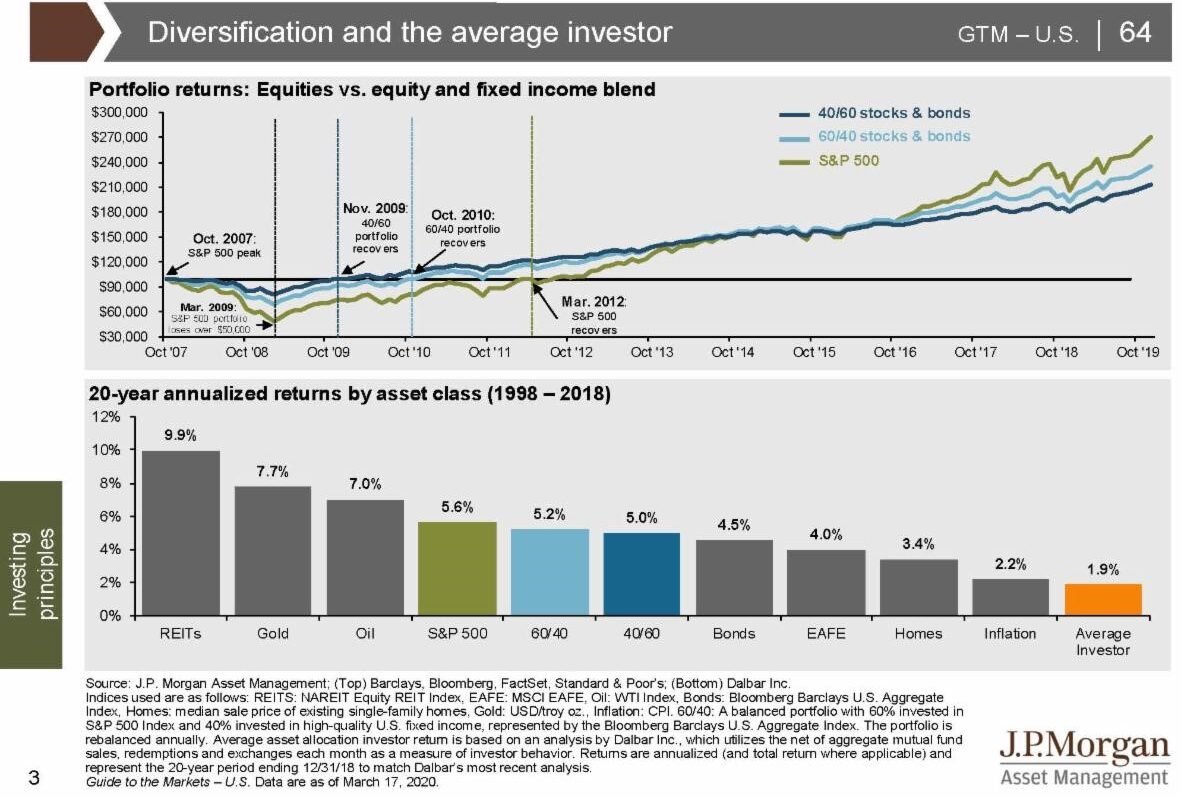

The second slide, Diversification and the average investor, shows the impact over the long run of utilizing a diversified portfolio. Please keep in mind that the diversified portfolio shown here is limited to just equities and bonds. Even in that case, holding just 60% in equities and 40% in bonds recovered to previous October 2007 values after the Great Recession in just three years. While at Optivest our clients diversify more broadly than just stocks and bonds. We also invest in REITs, real estate, gold, longevity contracts, and other alternatives.  In slide three, Time, diversification and the volatility of returns, illustrates the dramatic trading range portfolios can experience in a shorter periods of time but that those volatile movements actually smooth out when looking over a longer period of time.

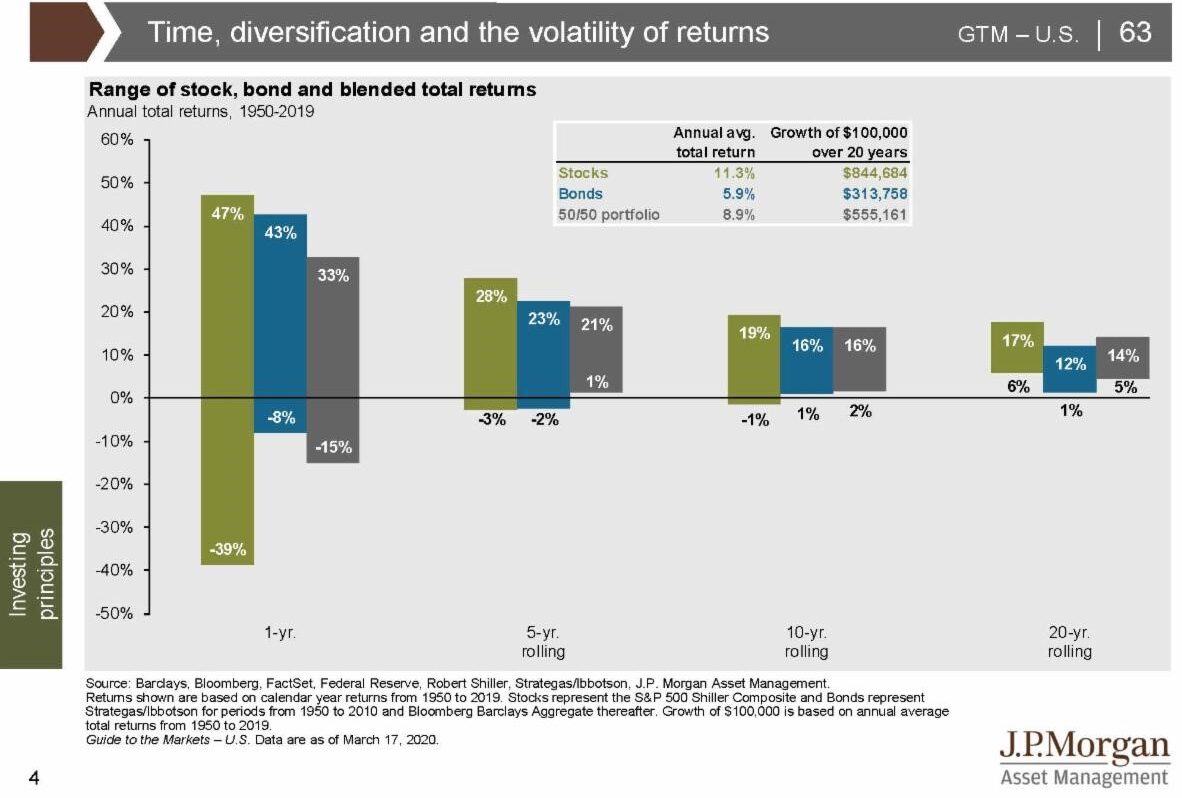

In slide three, Time, diversification and the volatility of returns, illustrates the dramatic trading range portfolios can experience in a shorter periods of time but that those volatile movements actually smooth out when looking over a longer period of time. And lastly, slide four, …but it’s extremely challenging to time the markets, repeats our advice from an earlier article that despite all the negative emotions, bad news and panic behavior all around us, staying fully invested achieves nearly 5 times the return over the panicked investor who sells out of investments and misses 10 best market snap back days and so on.

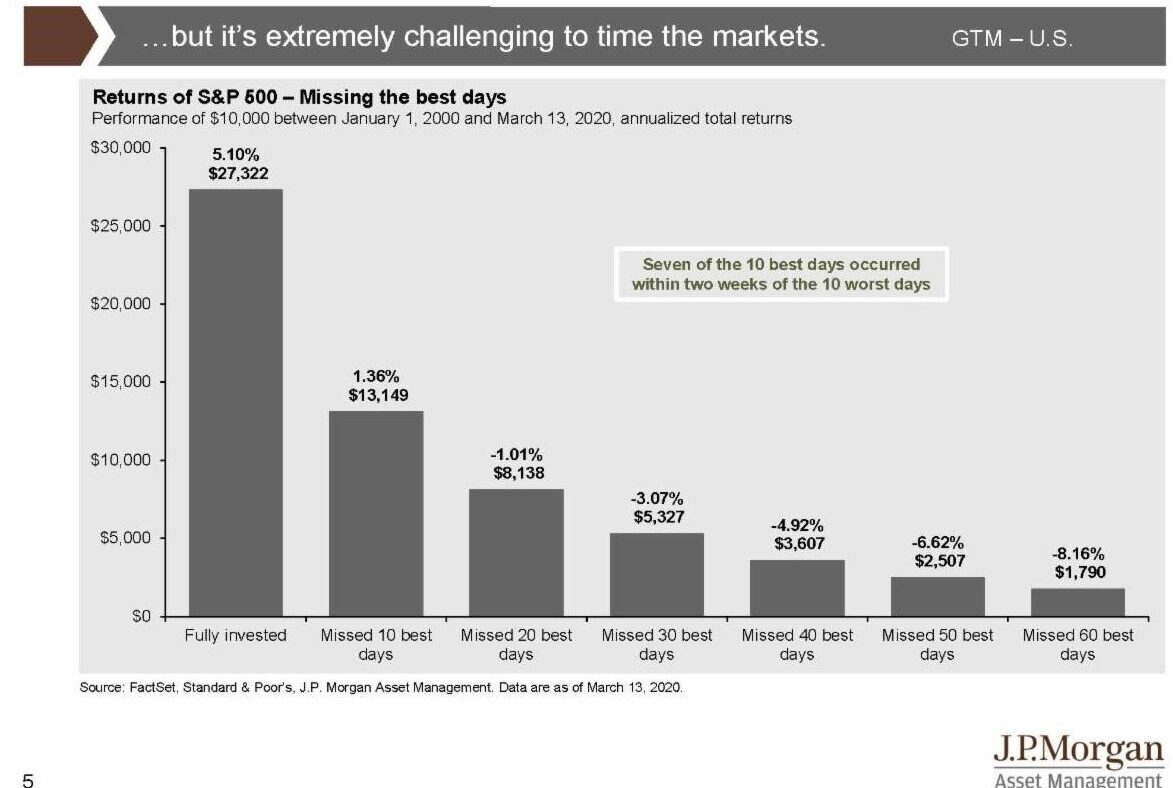

And lastly, slide four, …but it’s extremely challenging to time the markets, repeats our advice from an earlier article that despite all the negative emotions, bad news and panic behavior all around us, staying fully invested achieves nearly 5 times the return over the panicked investor who sells out of investments and misses 10 best market snap back days and so on. We stand committed to serving you. We want to thank you for your trust and confidence in these perilous time. Never hesitate to reach us with questions and of course we happily accept gifts of toilet paper if you’re in the neighborhood!

We stand committed to serving you. We want to thank you for your trust and confidence in these perilous time. Never hesitate to reach us with questions and of course we happily accept gifts of toilet paper if you’re in the neighborhood!

Keep well and stay healthy.