The Impact of Sanctions – March 7, 2022

We are now in week three of the Russian invasion into Ukraine and the market is still trying to digest the different news stories that are making headlines and fueling volatility. While our thoughts are with the Ukrainian people who have been impacted by a conflict, not of their choosing, we are also focused on how this will affect the global economy, the energy markets, and the Fed’s response.

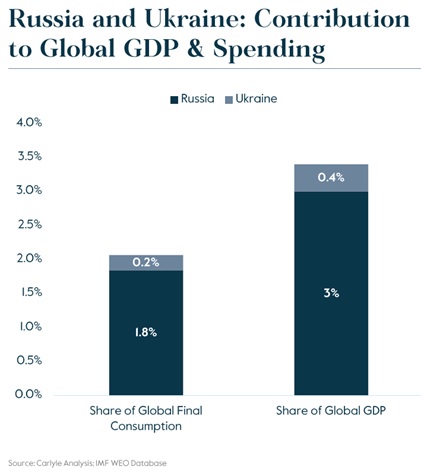

The Russian invasion of Ukraine is likely to depress global GDP growth and intensify elevated price pressures. However, the two economies combined account for less than 3.5% of global GDP and just 2% of global business sales. If energy production is spared from sanctions (at the time of this writing it has been), a -10% combined contraction in these economies would subtract modestly from global GDP this year and increase inflation rates by a similarly small magnitude. In terms of global demand, this is roughly equivalent to a war between the U.S. states of Florida and Nebraska.

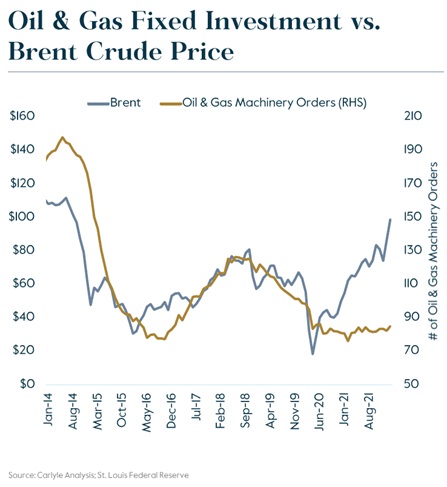

We are most likely to see negative effects if energy production is not spared or disrupted from sanctions. We are already starting to see the effects of potential sanctions and/or disruptions at the gas pump, with the average price of a gallon of gas hovering around $3.72 in the U.S. and $5.07 in California. While direct sanctions are the largest risk facing energy markets, supplies could also be disrupted by hostilities and banks unwilling or legally unable to transact with Russian counterparts. Russia exports approximately 10% of the world’s oil, which translates into 5 million barrels of crude oil a day. This makes Russia the world’s largest exporter and third-largest oil producer. The US has underinvested and underdeveloped upstream oil and gas infrastructure for some time as we have prioritized clean energy, which reduced the oil demand. Now we have a major imbalance between heightened demand and lower supply (see chart below). Investment is still well below levels one would expect at current prices and as a result, are likely to remain tight and prone to exaggerated price swings in the coming days and months.

This war has also changed the calculus for interest rate hikes by the Fed. Before the invasion, rate futures were pricing in a 70% likelihood of a 50 bps hike. Fast forward to today and that likelihood sits at a mere 6.5%. While a 50 bps hike seems very unlikely, it is all-but-certain that the Fed will hike by 25 bps at their next meeting in mid-March. The Fed has telegraphed that there is substantial uncertainty in their outlook. The conflict affects both components of the dual mandate (price stability and maximum sustainable employment) in opposite directions. It has dampened the prospects of global economic growth and has increased the threat of higher inflation. Looking past the Fed’s March meeting, the Fed will have a difficult task managing heightened inflation without putting our economy into a recession. Yet the case for a strong US economy and labor market is as evident as ever. The US added 678,000 workers to their payrolls in February, the biggest gain in seven months. The jobless rate fell to 3.8% from 4.0% a month earlier, edging closer to the 50-year low of 3.5% hit just before the pandemic. Lastly, wage growth appears to be cooling, a sign that the nationwide labor shortage might be easing as employers fill lower-wage positions that had long been dormant.

The situation overseas and the repercussions on the global economy are very fluid. We believe the current environment does not warrant a “sell everything” approach but we have made appropriate shifts to portfolios to reduce excess risk and are ready to make further adjustments if the environment takes a turn for the worst.