THIRD QUARTER ECONOMIC OUTLOOK – August 9, 2022

When Bad News is Good News

by LESLIE CALHOUN, President and CEO

After the stock market has had the worst performance for decades in the first half of 2022, with June being particularly punishing, the market has bounced back and is discounting the Fed rate hikes over the next 6 – 12 months. It takes a divergence like the rally of late in the face of discouraging economic news to remind us that the stock market is not the economy and vice versa. And just when the news seemed the worst in June during which the Nasdaq fell -22.44% and the MSCI EAFE fell -15.37%, the market turned on a dime in July and the Nasdaq rebounded +12.4%, the S&P +9.1%, and the DJIA + 6.7% driven by the bottom falling out on yields for the 10-Year Treasury from its June high of 3.5% to as low as 2.67% at July month end.

The Q1 and Q2 quarters both showed contraction in GDP. By some accounts, this could technically be defined as a recession but only the National Bureau of Economic Research (NBER) calls a recession. Meanwhile, economists and we agree that a recession also entails components of weakening employment and consumer spending. Neither of the second two components currently are indicative of recessionary environment. Some of the slowdown in growth are by design, thanks to interest rate hikes aimed at cooling the economy, chopping inflation. And some of the decline in GDP has been driven by mismatched trade as we are importing far more than we are exporting (strong consumer) and an ongoing drop in inventory purchases as businesses are still overstocked after oversized orders in 2021 meant to avoid supply chain unpredictability. But the slowing isn’t necessarily over as downside risk to earnings is building with forward guidance being provided pointing lower.

The Fed has a dual mandate to support price stability and maximum employment. Maximum employment is holding up as the July’s jobs report showed the US economy added 528,000 jobs, much stronger than predicted, bringing the unemployment rate down to historic lows of 3.5%. Price stability means inflation remains low and stable over the longer run and people can hold cash without having to worry that inflation will erode its purchasing power. These benchmarks are diverging creating a stubborn challenge for the Fed. The recent employment figures show not just job growth but also nominal incomes are rising at about 10% year over year in 2022. Higher employment and wages mean people have more money to spend which is inflationary. Added to wage growth, gasoline and energy prices have declined which basically acts like a tax cut which is inflationary. This is a time when bad news would be good news. It would be good to see unemployment tick up modestly and income growth slow down, pulling down private demand. This would allow the Fed some room to be less aggressive in hikes, reducing the chance they overshoot so quickly. We’d like to see the Fed’s bloated balance sheet have more time to run off before they have to fight another recession through QE and loosening credit.

Inflation is currently the biggest threat, not a recession. Fortunately, commodity prices have recently turned lower, retailers caught with too much inventory are dropping prices, freight rates are declining and the supply chain is improving. This is evidenced by bond yields falling from a high of 3.5% during the end of Q2. Should this already get picked up in the next CPI report (08/10), we can assume the Fed will pull back from the aggressive hike pace and the stock market is beginning to price this in.

Broader worries about the war in Ukraine, global financial outlook and aggressive rate hikes have prompted many economists to predict a recession next year. Europe is much closer to entering recession than the US as the war in Ukraine portends a difficult winter energy environment and food shortages. Also hurting Europe is the Italian debt crisis in the midst of political instability. Outsized risk on the European continent and already higher US rate environment will likely keep our US Dollar stronger for longer as we are lifting rates further and faster than the ECU, Great Britain or Asian economies. A strong US Dollar impacts profits of US businesses doing business abroad but such impacts eventually resolve through pricing and demand thus supporting lower current P/E ratios.

China has made egregious moves on many fronts and has suffered as a result. Their propped up property market is very vulnerable and losing the trust and confidence of their trade partners is likely to catch up to them. Sovereign powers have more reason than ever to develop alternative solutions to trade and manufacturing agreements with what has become an unreliable and confrontational country.

Portfolio Management

Portfolio Management

by RYAN THOMASON, CFA, Associate Portfolio Manager

The Rise of the US Consumer

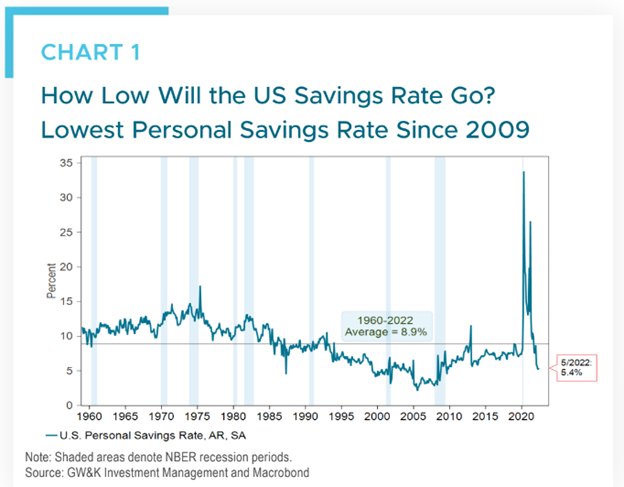

Since coming out of the COVID-induced lockdowns, US consumers amassed a massive savings cushion. We saw the personal savings rate, which is the difference between household disposable income and consumer expenditures, spike dramatically in April 2020 to a peak of 33.8% after having averaged around 7% in the five years before the pandemic. But the savings rate has since dropped to 5.4% as of May 2022, raising questions about the consumer-led recovery and the potential effects on inflation.

It is first important to understand what attributed to the spike in the savings rate. We first saw a negative shock of an initial sharp drop in consumer spending that was associated with social distancing and lockdowns. We then saw a positive shock to personal disposable income associated with the federal government’s massive pandemic assistance programs, which totaled $5 trillion.

Fast forward to today, the drop in the savings rate reflects several trends. As the health situation improved, consumer spending has recovered and has recently been growing faster than personal disposable income. We have also seen disposable income growth no longer be fueled by pandemic assistance. Lastly, consumer budgets are being challenged by inflation that hasn’t been seen since the 80s.

Although the savings rate has declined below its long-run average of 8.9%, Americans are still sitting on $2.6 trillion in excess savings. Excess savings of this magnitude represents an important wild card for the economic outlook. Higher consumer spending and demand have been factors that contributed to high inflation. The Fed has been using interest rates to combat this with the hopes that they can induce consumers to save at higher rates instead of spending their excess savings. If consumers continue to spend and push up the prices of goods, the Fed will have to act more aggressively to bring inflation down and this would ultimately lead to a recession. However, if consumers decide that their excess savings would be better off in high-yielding securities and cash instruments, the Fed may be able to achieve a “soft-landing” and avoid a recession. For the latter to play out, we must also see other factors (such as commodity prices, energy, and supply bottlenecks) improve as these would be less affected by higher interest rates. We are beginning to see signs of this occurring through commodity & energy prices normalizing and supply chains improving but there is still a long way to go.

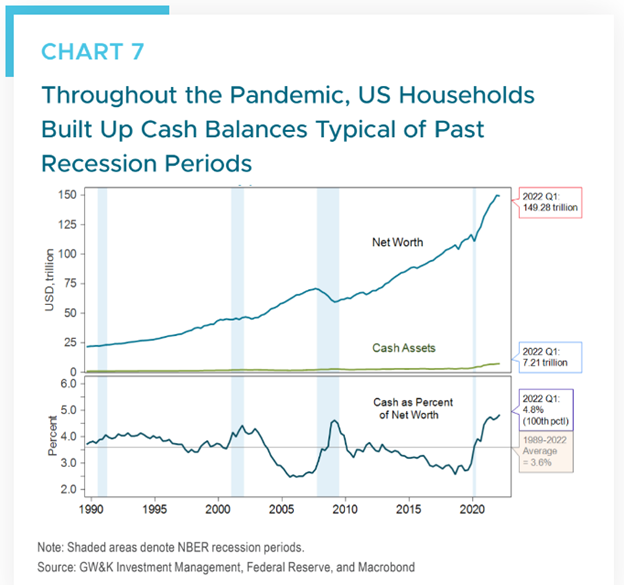

As shown in the chart below, American households through March 2022 were sitting on $7.2 trillion of cash. The chart also shows that overall household cash as a percent of net worth hit a post-1960 record of 4.8%. That is an elevated level normally associated with recession periods when investor sentiment is highly negative. In such periods, cash is prized for its option value – i.e., as dry powder for taking advantage of future lower prices.

In short, there truly is a lot of “cash on the sidelines”. The Fed’s job now is to make sure it stays on the sidelines by offering investors attractive bond yields and asset prices to keep it from fueling a further consumption boom. How far the Fed must raise interest rates and how fast it must shrink its balance sheet to do so remains to be seen. There is no playbook for exiting from a pandemic-induced super-spike in savings. Therefore, we expect the Fed to continue to be data-dependent and flexible in its approach.

Summary

Since the sharp COVID recession, while we all enjoyed great market returns and saw our residential property values soar, however growth was too heated and this current transition in valuations is toward more sustainable growth. The Fed is likely not done hiking but they might be able to slow the pace and magnitude of hikes soon.

Since early 2021 we have been shifting our portfolio models toward stable income generation through cash flow generating real estate and preferred equity exposures, mostly tied to real estate, to keep your income levels high when traditional fixed income has been punished by rising rates. Early in 2022, we reduced equity exposures to further push into low correlation income generating investments. During times of high volatility, we don’t have to focus on underlying asset valuations as much as the health and sustainability of cash flows to support your income needs.

Going forward we believe traditional correlations between equities and fixed income will eventually resume and active management will mean reallocating to high quality credit and eventually even high yield. Diversification still rules as our real estate exposure still generates higher returns than bonds. Real estate retains its value in portfolios by creating stability, higher yields and in many cases, tax-sheltered income.

Respectfully,

Leslie, Matt, Ryan & Ashlee